Frontier Airlines 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

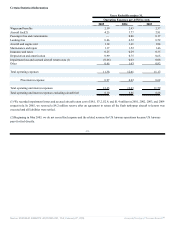

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon the consolidated financial

statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The

preparation of these financial statements requires us to make estimates and judgments that affect the reported amount of assets and

liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities at the date of our financial statements.

Actual results may differ from these estimates under different assumptions and conditions.

Critical accounting policies are defined as those that are reflective of significant judgments and uncertainties, and are

sufficiently sensitive to result in materially different results under different assumptions and conditions. We believe that our critical

accounting policies are limited to those described below. For a detailed discussion on the application of these and other accounting

policies, see Note 2 in the notes to the consolidated financial statements.

Impairments to Long-Lived Assets. We record impairment losses on long-lived assets used in operations when events

and circumstances indicate that the assets might be impaired and the undiscounted cash flows estimated to be generated by

those assets are less than the carrying amount of those items. Our cash flow estimates are based on historical results adjusted

to reflect our best estimate of future market and operating conditions. Our estimates of fair value represent our best estimate

based on industry trends and reference to market rates and transactions. We review, at least annually, the estimated useful

lives and salvage values for our aircraft and spare parts.

Aircraft Maintenance and Repair. We follow a method of expensing such amounts as incurred rather than accruing for

expected costs or capitalizing and amortizing such costs. However, maintenance and repairs for engines and airframe

components under power-by-the-hour contracts (such as avionics, APUs, wheels and brakes) are accrued for as the aircraft

are operated; therefore, amounts are expensed based upon actual hours flown.

Warrants. Warrants issued to non-employees are accounted for under SFAS No. 123, Accounting for Stock-Based

Compensation, and EITF 96-18, Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring,

or in Conjunction with Selling, Goods or Services, at fair value on the measurement date. Fair value for warrants issued to

Delta (for which a measurement date has occurred) have been determined based upon the estimated fair value of the equity

instrument issued rather than the consideration received because we believe it is more reliably measured. Various option

pricing models are available; however, we have used a model that allows continuous compounding of dividends which begins

three years after the grant date and the dilutive effects of our initial public offering and the follow-on offerings in 2005.

Option pricing models require estimates of dividend yield, a risk free rate commensurate with the warrant term, stock

volatility and the expected life of the warrant. Each of these variables has been determined based upon relevant industry

market data, our strategic business plan and consultation with appropriate professionals experienced in valuing similar equity

instruments.

Income Taxes. The Company has generated significant net operating losses (“NOLs”) for federal income tax purposes

primarily from accelerated depreciation on owned aircraft. In July 2005, Wexford Capital LLC’s ownership percentage of the

Company was reduced to less than 50% as a result of a follow-on offering of our common stock. As a result of this decrease

in ownership, the utilization of NOLs generated prior to July 2005 are subject to an annual limitation under Internal Revenue

Code Section 382 (“IRC 382”). The annual limitation is based upon the enterprise value of the Company on the IRC 382

ownership change date multiplied by the applicable long-term tax exempt rate. If the utilization of pre July 2005 NOLs

becomes uncertain in future years, we will be required to record a valuation allowance for the NOLs not expected to be

utilized.

Intangible Commuter Slots. The Company acquired commuter slots at the New York-LaGuardia and Ronald Reagan

Washington National airports from US Airways. The estimated useful lives of these commuter slots were determined based

upon the period of time cash flows are expected to generated by the commuter slots and by researching the estimated useful

lives of commuter slots or similar intangibles by other airlines. In addition, an estimated residual value was determined using

estimates of the expected fair value of the commuter slots at the end of the expected useful life. The residual value will be

assessed annually for impairment. The estimated useful lives are reviewed annually.

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠