Frontier Airlines 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Purchase Commitments

Subsequent to December 31, 2005, we acquired one aircraft through debt financing from a bank and the aircraft manufacturer

with a fifteen year term and an interest rate of 6.68%. We have substantial commitments for capital expenditures, primarily for the

acquisition of new aircraft. We intend to finance these aircraft through long-term loans or lease arrangements, although there can be

no assurance we will be able to do so.

As of December 31, 2005, our code-share agreements required that we acquire from the aircraft manufacturer (subject to

financing commitments) and place into service an additional seven regional jets over the next 9 months. Embraer's current list price of

these 7 regional jets is approximately $196.8 million. We also had four additional firm orders which have not yet been allotted to a

major airline partner. Embraer’s current list price of these 4 regional jets is approximately $112.5 million. We have commitments to

obtain financing for these 11 firm order regional jets. These commitments are subject to customary closing conditions.

We expect to fund future capital commitments through internally generated funds, third-party aircraft financings, and debt

and other financings.

We currently anticipate that our available cash resources, cash generated from operations and anticipated third-party

financing arrangements will be sufficient to meet our anticipated working capital and capital expenditure requirements for at least the

next 12 months. We may need to raise additional funds, however, to fund more rapid expansion, principally the acquisition of

additional aircraft, or meet unanticipated working capital requirements. It is possible that future funding may not be available to us on

favorable terms, or at all.

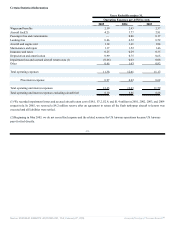

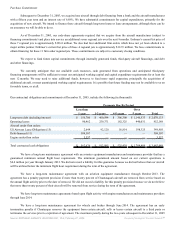

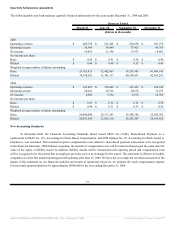

Our contractual obligations and commitments at December 31, 2005, include the following (in thousands):

Payments Due By Period

Less than

1 year 1-3 years 4-5 years

Over

5 years Total

Long-term debt (including interest) $ 156,706 $ 460,594 $ 306,300 $ 1,146,533 $ 2,070,133

Operating leases 90,462 259,371 162,325 440,031 952,189

Aircraft under firm orders:

US Airways Lease Obligations (15) 2,644 92,120 56,814 198,325 349,903

Debt-financed (11) 309,307 — — — 309,307

Engine under firm orders 3,557 — — — 3,557

Total contractual cash obligations $ 562,676 $ 812,085 $ 525,439 $ 1,784,889 $ 3,685,089

We have a long-term maintenance agreement with an avionics equipment manufacturer and maintenance provider that has a

guaranteed minimum annual flight hour requirement. The minimum guaranteed amount based on our current operations is

$4.4 million per year through January 2012. We did not record a liability for this guarantee because we did not believe that our aircraft

will be utilized below the minimum flight hour requirement during the term of the agreement.

We have a long-term maintenance agreement with an aviation equipment manufacturer through October 2013. The

agreement has a penalty payment provision if more than twenty percent of Chautauqua's aircraft are removed from service based on

the annual flight activity prior to the date of removal. We did not record a liability for this penalty provision because we do not believe

that more than twenty percent of their aircraft will be removed from service during the term of the agreement.

We have long-term maintenance agreements based upon flight activity with engine manufacturers and maintenance providers

through June 2014.

We have a long-term maintenance agreement for wheels and brakes through June 2014. The agreement has an early

termination penalty if Chautauqua removes the equipment from certain aircraft, sells or leases certain aircraft to a third party or

terminates the services prior to expiration of agreement. The maximum penalty during the two years subsequent to December 31, 2005

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠