Frontier Airlines 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

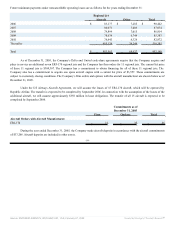

financial statements. The Company had accumulated other comprehensive loss relating to treasury lock agreements of $4,176 and

$4,168, net of tax, at December 31, 2005 and 2004, respectively. There were no other comprehensive income components for the

years ended December 31, 2003.

Income Taxes—Republic accounts for income taxes using the asset and liability method. Under the asset and liability

method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the

financial statement carrying amounts for existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities

are measured using enacted tax rates expected to apply to taxable income in future years in which those temporary differences are

expected to be recovered or settled. The measurement of deferred tax assets is adjusted by a valuation allowance, if necessary, to

recognize the future tax benefits to the extent, based on available evidence; it is more likely than not they will be realized.

Aircraft Maintenance and Repair is charged to expense as incurred under the direct expense method. Engines and certain

airframe component overhaul and repair costs are subject to power-by-the-hour contracts with external vendors and are accrued as the

aircraft are flown.

Use of Estimates—The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues

and expenses during the reporting periods. Under the code-share agreements, we estimate operating costs for certain “pass through”

costs and record revenue based on these estimates. Actual results could differ from those estimates.

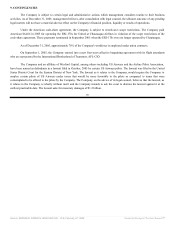

Revenue Recognition—Revenues are recognized in the period the service is provided. The Company recognizes revenues

and expenses in accordance with the terms of the fixed fee code-share agreements, which includes pass-through costs. The Company

recognizes lease revenue for sub-leases for five ERJ-145 aircraft leased to an airline in Mexico and 3 ERJ-170 aircraft to US Airways.

In addition, the Company recognizes license revenue from US Airways for commuter slots that were purchased by the Company and

are being utilized by US Airways through 2006 for the New-York LaGuardia commuter slots, and through 2016 for the Ronald

Reagan Washington National commuter slots. Revenues from sub-leases and the commuter slots are recognized when earned and

included in other operating revenue.

-54-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠