Frontier Airlines 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Code-Share Agreements

On September 12, 2004, US Airways, which represented 21% of our revenue for the year ended December 31, 2005, filed a

petition for Chapter 11 bankruptcy protection. We have been paid for all amounts due post-petition in accordance with our code-share

agreement. In October 2005, US Airways emerged from bankruptcy. We received 6,638 shares of US Airways common stock for our

pre-petition claims. The fair value of the shares as of December 31, 2005 was $248,000. United, which represented 32% of our

passenger revenues for the year ended December 31, 2005, emerged from bankruptcy on February 1, 2006.

Delta, which represented 34% of our passenger revenues for the year ended December 31, 2005, is attempting to reorganize

its respective businesses under Chapter 11 of the bankruptcy code. We continue to operate normal flight schedules for Delta; however,

contingency plans have been developed to address potential outcomes of the Delta bankruptcy proceedings.

Termination of any of our regional jet code-share agreements could have a material adverse effect on our financial position,

results of operations and cash flows.

Fleet Transition and Growth

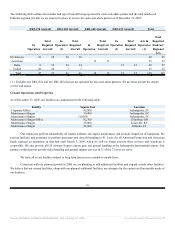

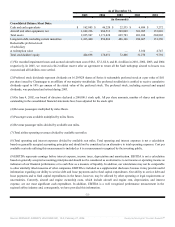

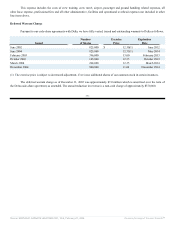

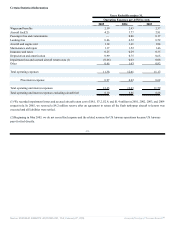

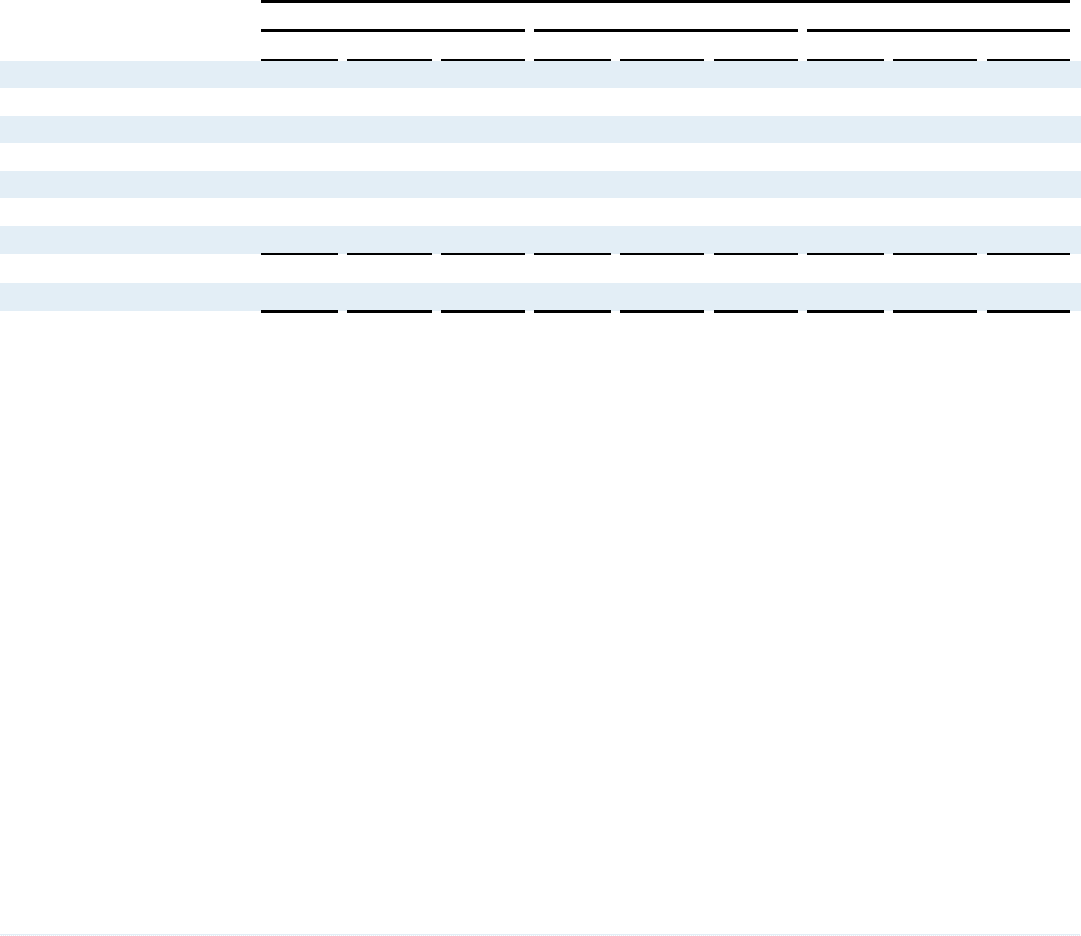

The following table sets forth the number and type of aircraft in service and operated by us at the dates indicated:

December 31,

2003 2004 2005

Total Owned Leased Total Owned Leased Total Owned Leased

Regional Jets:

Embraer ERJ-135 LR (1) 15 15 — 17 15 2 17 15 2

Embraer ERJ-140 LR 15 11 4 15 11 4 15 11 4

Embraer ERJ-145 LR (2) 53 12 41 68 25 43 63 22 41

Embraer ERJ-170 LR — — — 11 11 — 47 42 5

Turboprops:

Saab 340 (3) 21 — 21 17 4 13 — — —

Total 104 38 66 128 66 62 142 90 52

(1) Two of these aircraft are used for charter at December 31, 2004 and 2005.

(2) Two of these aircraft are used for charter and as spares at December 31, 2005.

(3) Excludes two, one and five Saab 340 aircraft held for sale at December 31, 2003, 2004 and 2005, respectively.

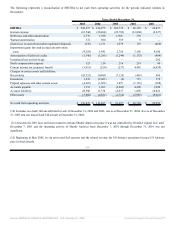

We recorded impairment losses and accrued aircraft return cost of $2.8 and $1.4 million in 2003 and 2004, respectively. The

impairment losses reduced the carrying value of the owned Saab 340 aircraft to be disposed of to the estimated fair value less costs to

sell. The impairment losses were based on the estimated fair values obtained from aircraft dealers, less selling costs. The accrued

aircraft return costs represented the estimate of the Company's overhaul and return costs in order to meet required return conditions.

In December 2005, we reversed a $4.2 million reserve for estimated return costs after the Saab turboprops were returned to lessors and

all liabilities were settled.

During 1999, we began operating Embraer regional jets on behalf of US Airways under a fixed-fee arrangement. There were

34, 35 and 40 Embraer aircraft operating on behalf of US Airways at December 31, 2003, 2004 and 2005, respectively. During 2000,

we began operating Saab 340 turboprops and Embraer regional jets on behalf of TWA under a fixed-fee arrangement; TWA was

subsequently acquired by American. There were 15 Embraer regional jets operating under the agreement with American at

December 31, 2003, 2004 and 2005. At December 31, 2003, 2004 and 2005, respectively, we had 34, 39 and 48 aircraft in operation

under our agreements with Delta. We began flying Embraer regional jets and Saab turboprops for United in June 2004 and at

December 31, 2004 and 2005 respectively, we had 20 and 35 Embraer regional jets in operation under the agreement with United. In

December 2005, Shuttle America’s turboprop code-share agreement with United expired.

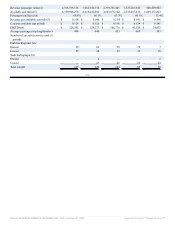

During 2003, 94.5% of our ASMs and 91.0% of our passenger revenues were generated under fixed-fee agreements. During

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, February 27, 2006 Powered by Morningstar® Document Research℠