Foot Locker 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

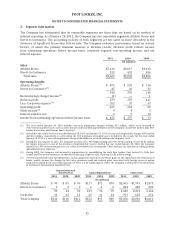

17. Income Taxes − (continued)

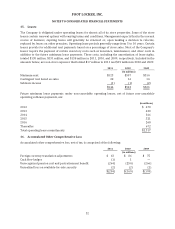

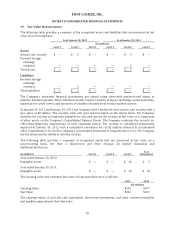

Deferred income taxes are provided for the effects of temporary differences between the amounts of assets

and liabilities recognized for financial reporting purposes and the amounts recognized for income tax

purposes. Items that give rise to significant portions of the Company’s deferred tax assets and deferred tax

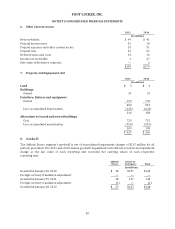

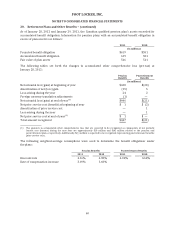

liabilities are as follows: 2011 2010

(in millions)

Deferred tax assets:

Tax loss/credit carryforwards and capital loss $ 18 $ 31

Employee benefits 77 67

Property and equipment 166 173

Straight-line rent 27 27

Goodwill and other intangible assets 21 23

Other 32 32

Total deferred tax assets 341 353

Valuation allowance (5) (6)

Total deferred tax assets, net 336 347

Deferred tax liabilities:

Inventories 71 63

Other 86

Total deferred tax liabilities 79 69

Net deferred tax asset $257 $278

Balance Sheet caption reported in:

Deferred taxes $284 $296

Other current assets 2 2

Accrued and other current liabilities (24) (20)

Other liabilities (5) —

$257 $278

The Company operates in multiple taxing jurisdictions and is subject to audit. Audits can involve complex

issues that may require an extended period of time to resolve. A taxing authority may challenge positions

that the Company has adopted in its income tax filings. Accordingly, the Company may apply different tax

treatments for transactions in filing its income tax returns than for income tax financial reporting. The

Company regularly assesses its tax positions for such transactions and records reserves for those

differences.

The Company’s U.S. Federal income tax filings have been examined by the Internal Revenue Service

through 2010. The Company is participating in the IRS’s Compliance Assurance Process (‘‘CAP’’) for 2011,

which is expected to conclude during 2012. The Company has started the CAP for 2012. Due to the recent

utilization of net operating loss carryforwards, the Company is subject to state and local tax examinations

effectively including years from 1996 to the present. To date, no adjustments have been proposed in any

audits that will have a material effect on the Company’s financial position or results of operations.

As of January 28, 2012, the Company has a valuation allowance of $5 million to reduce its deferred tax

assets to an amount that is more likely than not to be realized. The valuation allowance primarily relates to

the deferred tax assets arising from a capital loss associated with the 2008 impairment of the Northern

Group note receivable, state tax loss carryforwards, and state tax credits. A full valuation allowance is

required for the capital loss because the Company does not anticipate realizing capital gains to utilize this

loss. The valuation allowance for state tax loss and credit carryforwards decreased in 2011 principally due

to anticipated expirations of those attributes.

54