Foot Locker 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

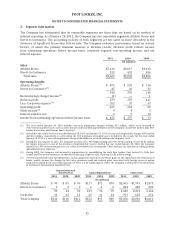

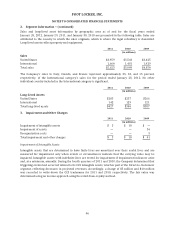

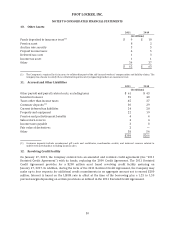

15. Leases

The Company is obligated under operating leases for almost all of its store properties. Some of the store

leases contain renewal options with varying terms and conditions. Management expects that in the normal

course of business, expiring leases will generally be renewed or, upon making a decision to relocate,

replaced by leases on other premises. Operating lease periods generally range from 5 to 10 years. Certain

leases provide for additional rent payments based on a percentage of store sales. Most of the Company’s

leases require the payment of certain executory costs such as insurance, maintenance, and other costs in

addition to the future minimum lease payments. These costs, including the amortization of lease rights,

totaled $130 million, $131 million, and $138 million in 2011, 2010, and 2009, respectively. Included in the

amounts below, are non-store expenses that totaled $17 million in 2011 and $15 million in 2010 and 2009.

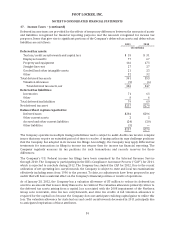

2011 2010 2009

(in millions)

Minimum rent $525 $507 $514

Contingent rent based on sales 20 16 14

Sublease income (1) (1) (2)

$544 $522 $526

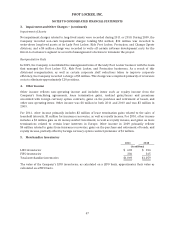

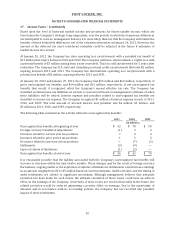

Future minimum lease payments under non-cancelable operating leases, net of future non-cancelable

operating sublease payments, are:

(in millions)

2012 $ 478

2013 420

2014 366

2015 321

2016 260

Thereafter 672

Total operating lease commitments $2,517

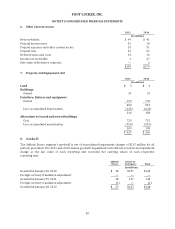

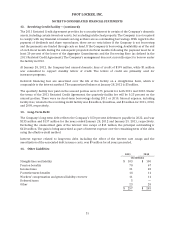

16. Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss, net of tax, is comprised of the following:

2011 2010 2009

(in millions)

Foreign currency translation adjustments $ 63 $ 86 $ 75

Cash flow hedges (1) 1 —

Unrecognized pension cost and postretirement benefit (264) (254) (266)

Unrealized loss on available-for-sale security (2) (2) (2)

$(204) $(169) $(193)

52