Foot Locker 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

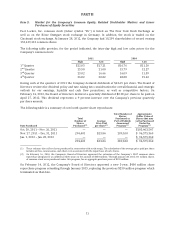

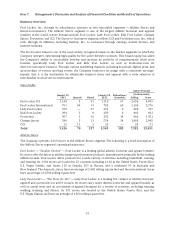

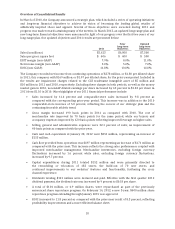

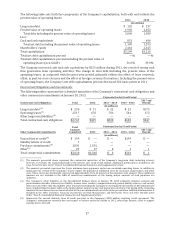

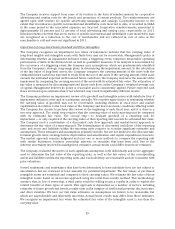

The following table represents a summary of sales and operating results, reconciled to income from

continuing operations before income taxes.

2011 2010 2009

(in millions)

Sales

Athletic Stores $5,110 $4,617 $4,448

Direct-to-Customers 513 432 406

$5,623 $5,049 $4,854

Operating Results

Athletic Stores

(1)

$ 495 $ 329 $ 114

Direct-to-Customers

(2)

45 30 32

540 359 146

Restructuring (charge) income

(3)

(1) — 1

Division profit 539 359 147

Less: Corporate expense

(4)

102 97 67

Operating profit 437 262 80

Other income

(5)

44 3

Earnings before interest expense and income taxes 441 266 83

Interest expense, net 6 9 10

Income from continuing operations before income taxes $ 435 $ 257 $ 73

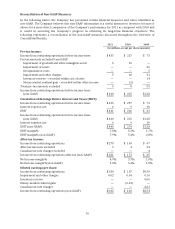

(1) The year ended January 30, 2010 includes non-cash impairment charges totaling $32 million, which were recorded to

write-down long-lived assets such as store fixtures and leasehold improvements at the Company’s Lady Foot Locker, Kids Foot

Locker, Footaction, and Champs Sports divisions.

(2) Included in the results for the year ended January 28, 2012 and January 29, 2011 are non-cash impairment charges of $5 million

and $10 million, respectively, to write down the CCS tradename intangible asset. Included in the results for the year ended

January 30, 2010 is a non-cash impairment charge of $4 million to write off software development costs.

(3) During the first quarter of 2011, the Company increased its 1993 Repositioning and 1991 Restructuring reserve by $1 million

for repairs necessary to one of the locations comprising this reserve. During the year ended January 30, 2010, the Company

adjusted its 1999 restructuring reserves to reflect a favorable lease termination. These amounts are included in selling, general,

and administrative expenses.

(4) During 2009, the Company restructured its organization by consolidating the Lady Foot Locker, Foot Locker U.S., Kids Foot

Locker, and Footaction businesses in addition to reducing corporate staff, resulting in a $5 million charge.

(5) Included in the year ended January 29, 2011 is a $2 million gain to reflect the Company’s settlement of its investment in the

Reserve International Liquidity Fund.

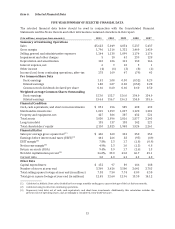

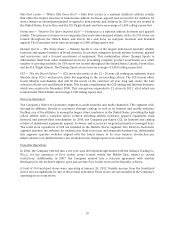

Sales

All references to comparable-store sales for a given period relate to sales from stores (including sales from

the Direct-to-Customers segment and sales from stores that have been relocated or remodeled during the

relevant periods) that are open at the period-end, that have been open for more than one year, and exclude

the effect of foreign currency fluctuations. Stores opened and closed during the period are not included.

Sales from acquired businesses that include the purchase of inventory are included in the computation of

comparable-store sales after 15 months of operations.

Sales in 2011 increased to $5,623 million, or by 11.4 percent as compared with 2010. Excluding the effect

of foreign currency fluctuations, sales increased 9.7 percent as compared with 2010. Comparable-store

sales increased by 9.8 percent. This increase primarily reflects higher footwear sales. Apparel and

accessories sales also increased, which represented approximately 24 percent of sales, reflecting a modest

increase over the corresponding prior-year period of 23 percent.

Sales of $5,049 million in 2010 increased by 4.0 percent from sales of $4,854 million in 2009. Excluding the

effect of foreign currency fluctuations, sales increased 4.6 percent as compared with 2009.

Comparable-store sales increased by 5.8 percent.

19