Foot Locker 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

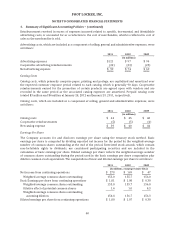

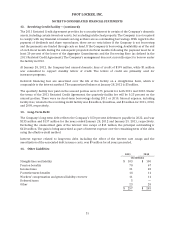

3. Impairment and Other Charges − (continued)

Impairment of Assets

No impairment charges related to long-lived assets were recorded during 2011 or 2010. During 2009, the

Company recorded non-cash impairment charges totaling $36 million; $32 million was recorded to

write-down long-lived assets at its Lady Foot Locker, Kids Foot Locker, Footaction, and Champs Sports

divisions, and a $4 million charge was recorded to write off certain software development costs for the

Direct-to-Customers segment as a result of management’s decision to terminate the project.

Reorganization Costs

In 2009, the Company consolidated the management team of the Lady Foot Locker business with the team

that managed the Foot Locker U.S., Kids Foot Locker, and Footaction businesses. As a result of this

divisional reorganization, as well as certain corporate staff reductions taken to improve corporate

efficiency, the Company recorded a charge of $5 million. This charge was comprised primarily of severance

costs to eliminate approximately 120 positions.

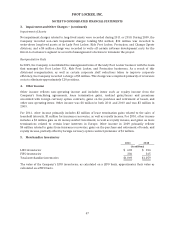

4. Other Income

Other income reflects non-operating income and includes items such as royalty income from the

Company’s franchising agreements, lease termination gains, realized gains/losses and premiums

associated with foreign currency option contracts, gains on the purchase and retirement of bonds, and

other non-operating items. Other income was $4 million in both 2011 and 2010 and was $3 million in

2009.

For 2011, other income primarily includes $2 million of lease termination gains related to the sales of

leasehold interests, $1 million for insurance recoveries, as well as royalty income. For 2010, other income

includes a $2 million gain on its money-market investment, as well as royalty income, and gains on lease

terminations related to certain lease interests in Europe. Other income in 2009 primarily reflects

$4 million related to gains from insurance recoveries, gains on the purchase and retirement of bonds, and

royalty income, partially offset by foreign currency option contract premiums of $1 million.

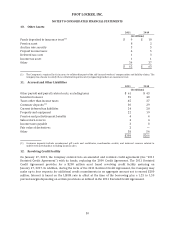

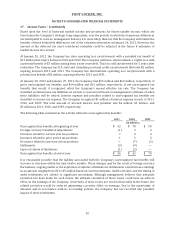

5. Merchandise Inventories

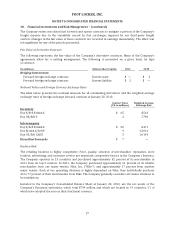

2011 2010

(in millions)

LIFO inventories $ 683 $ 694

FIFO inventories 386 365

Total merchandise inventories $1,069 $1,059

The value of the Company’s LIFO inventories, as calculated on a LIFO basis, approximates their value as

calculated on a FIFO basis.

47