Family Dollar 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

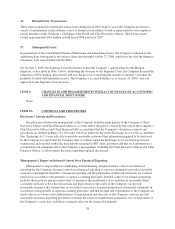

16. Related Party Transactions:

There were no material related party transactions during fiscal 2009. In prior years, the Company purchased a

variety of merchandise in the ordinary course of business from entities owned or represented by non-employee

family members of the Company’s Chairman of the Board and Chief Executive Officer. These transactions

totaled approximately $0.8 million in both fiscal 2008 and fiscal 2007.

17. Subsequent Events:

In preparation of the Consolidated Financial Statements and related disclosures, the Company evaluated events

and transactions subsequent to the balance sheet date through October 27, 2009, which was the date the financial

statements were issued (filed with the SEC).

On October 5, 2009, the Supreme Court decided not to hear the Company’s appeal related to the Morgan

litigation, as described in Note 9 above. Following the decision by the Supreme Court, the Company has paid the

judgment of $35.6 million, plus interest and is in the process of resolving the amount of attorney’s fees that the

plaintiffs Counsel will ultimately receive. The Company’s accrued liabilities as of August 29, 2009, were not

impacted by the Supreme Court decision.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING

AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Based on an evaluation by management of the Company (with the participation of the Company’s Chief

Executive Officer and Chief Financial Officer), as of the end of the period covered by this report, the Company’s

Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and

procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended,

(the “Exchange Act”)) were effective to provide reasonable assurance that information required to be disclosed

by the Company in reports that the Company files or submits under the Exchange Act is recorded, processed,

summarized and reported within the time periods specified in SEC rules and forms and that such information is

accumulated and communicated to the Company’s management, including the Chief Executive Officer and Chief

Financial Officer, to allow timely decisions regarding required disclosures.

Management’s Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial

reporting for the Company. Internal control over financial reporting is a process designed to provide reasonable

assurance regarding the reliability of financial reporting and the preparation of financial statements for external

purposes in accordance with generally accepted accounting principles. Internal control over financial reporting

includes those policies and procedures that: (i) pertain to the maintenance of records that in reasonable detail

accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide

reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in

accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are

made only in accordance with authorizations of management and directors of the Company; and (iii) provide

reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of

the Company’s assets that could have a material effect on the financial statements.

58