Family Dollar 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

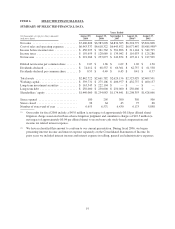

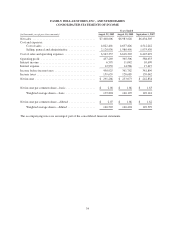

The following table shows our other commercial commitments at the end of fiscal 2009:

Other Commercial Commitments (in thousands)

Total Amounts

Committed

Standby letters of credit .......................................... $202,288

Surety bonds ................................................... 56,876

Total ......................................................... $259,164

A substantial portion of the outstanding amount of standby letters of credit (which are primarily renewed on

an annual basis) is used as surety for future premium and deductible payments to our workers’ compensation and

general liability insurance carrier. We accrue for these future payment liabilities as described in the “Critical

Accounting Policies” section of this discussion. Included in the outstanding amount of surety bonds is a $53.4

million bond that we obtained in connection with an adverse legal judgment, as discussed in Note 9 to the

Consolidated Financial Statements included in this Report.

Recent Accounting Pronouncements

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS 157”). SFAS 157

defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles

and expands disclosures about fair value measurements. SFAS 157 is effective for the first annual period

beginning after November 15, 2007. The effective date has been delayed for non-financial assets and liabilities to

the first annual period beginning after November 15, 2008. We adopted SFAS 157 during the first quarter of

fiscal 2009. See Note 2 to the Consolidated Financial Statements included in this Report for more information on

our adoption of SFAS 157.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities—Including an Amendment of FASB Statement No. 115” (“SFAS 159”). SFAS 159 permits

all entities the option to measure many financial instruments and certain other items at fair value. If a company

elects the fair value option for an eligible item, then it will report unrealized gains and losses on those items at

each subsequent reporting date. SFAS 159 is effective for fiscal years beginning after November 15, 2007. We

did not elect the fair value option under SFAS 159.

In April 2009, the FASB issued FASB Staff Position (“FSP”) No. 107-1 and Accounting Principles Board

(“APB”) Opinion No. 28-1, “Interim Disclosures about Fair Value of Financial Instruments” (FSP FAS 107-1

and APB 28-1”). This FSP amends SFAS No. 107, “Disclosures about Fair Value of Financial Instruments,” to

require disclosures about fair value of financial instruments for interim reporting periods of publicly traded

companies as well as in annual financial statements. This FSP also amends APB Opinion No. 28, “Interim

Financial Reporting,” to require those disclosures in summarized financial information at interim reporting

periods. The FSP is effective for interim reporting periods ending after June 15, 2009. We adopted FSP FAS

107-1 and APB 28-1 during the fourth quarter of fiscal 2009. The adoption did not have a material impact on our

Consolidated Financial Statements.

In April 2009, the FASB issued FSP FAS No. 115-2 and FAS No. 124-2, “Recognition and Presentation of

Other-Than-Temporary Impairments” (“FSP FAS 115-2 and FAS 124-2”). This FSP amends the other-than-

temporary impairment guidance in U.S. GAAP for debt securities to make the guidance more operational and to

improve the presentation and disclosure of other-than-temporary impairments on debt and equity securities in the

financial statements. This FSP does not amend existing recognition and measurement guidance related to other-

than-temporary impairments of equity securities. The FSP is effective for interim and annual reporting periods

ending after June 15, 2009. We adopted FSP FAS 115-2 and FAS 124-2 during the fourth quarter of fiscal 2009.

The adoption did not have a material impact on our Consolidated Financial Statements.

28