Family Dollar 2009 Annual Report Download - page 21

Download and view the complete annual report

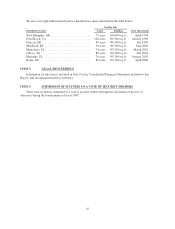

Please find page 21 of the 2009 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.violated the Fair Labor Standards Act (FLSA) and other state laws by classifying Store Managers as “exempt”

employees, not entitled to overtime compensation. We are subject to a series of lawsuits challenging that

classification, and recently incurred a final judgment against us in federal court. There are currently additional

lawsuits pending in the 4th Circuit Court of Appeals and in federal district court in North Carolina. We classified

Store Managers as “exempt” employees in good faith and continue to believe that Store Managers are “exempt”

employees under FLSA, that they should be paid as salaried employees, and that have been and are being

properly compensated under both federal and state laws. We intend to defend ourselves vigorously against such

claims. However, if at some point in the future the Company determines that a reclassification of some or all of

its Store Managers as non-exempt employees under the FLSA is required, such action could have a material

adverse effect on the Company’s financial position, liquidity or results of operation. At this time, we cannot

quantify the impact of such a determination. The outcome of any litigation is uncertain and it may subject the

Company to liability that could have a material adverse effect on its financial position, liquidity, or results of

operations. See Note 9 to the Consolidated Financial Statements included in this Report for more information on

our outstanding litigation.

Our ability to attract and retain employees could affect our business.

Our growth could be adversely impacted by our inability to attract and retain employees at the store

operations level, in distribution facilities, and at the corporate level, including our senior management team, at

costs which allow us to profitability conduct our operations. For example, we believe that the retention of

managers at the store level is one factor in reducing inventory shrinkage resulting from employee theft. Various

other factors, such as overall labor availability, wage rates, union organizing activity, regulatory or legislative

impacts and various benefit costs could all impact our ability to attract and retain employees negatively and may

affect our results of operations adversely.

Higher costs or any failure to achieve targeted results associated with the implementation of new programs or

initiatives could affect our results of operations adversely.

We are undertaking a variety of operating initiatives and infrastructure initiatives related to, among other

things, merchandising and supply chain systems, store technology, merchandise assortment and related schematic

changes, and real estate remodeling and expansion goals. These changes may result in temporary disruptions to

our business and negatively impact sales and the failure to properly execute any of these initiatives or the failure

to obtain the anticipated results of such initiatives could have an adverse impact on our future operating results.

Our business is slightly seasonal and adverse events during the holiday season could impact our operating

results negatively.

Our business is slightly seasonal, with the highest percentage of sales (approximately 27% of total annual

sales over the last five fiscal years) occurring during the second fiscal quarter (December, January,

February). We purchase significant amounts of seasonal inventory in anticipation of the holiday season. Adverse

events, such as deteriorating economic conditions, higher unemployment, higher gas prices, public transportation

disruptions, or unusual weather can result in lower than planned sales during the holiday season. This could lead

to lower sales or to unanticipated markdowns, impacting our financial condition and results of operations

negatively.

Our failure to comply with our debt covenants could affect our capital resources, financial condition and

liquidity adversely.

Our debt agreements contain certain restrictive covenants, which impose various operating and financial

restrictions on us. Such restrictions include, but are not limited to, a consolidated debt to consolidated

capitalization ratio, a fixed charge coverage ratio, and a priority debt ratio. Our failure to comply with the

restrictive covenants in our debt agreements, as a result of one or more of the factors listed in this section, could

13