Family Dollar 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

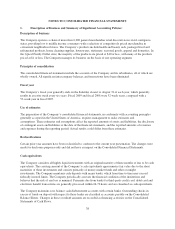

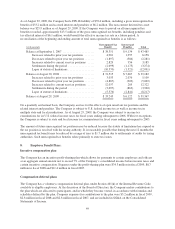

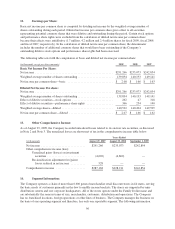

The following table summarizes the components of income tax expense in fiscal 2009, fiscal 2008 and fiscal

2007:

2009 2008 2007

(in thousands)

Income tax

expense

% of pre-tax

income

Income tax

expense

% of pre-tax

income

Income tax

expense

% of pre-tax

income

Computed federal income tax ...... $157,823 35.0% $126,610 35.0% $133,664 35.0%

State income taxes, net of federal

income tax benefit ............. 11,599 2.6 7,863 2.2 14,092 3.7

Valuation allowance ............. (653) (0.2) 6,350 1.8 — —

Other ......................... (9,110) (2.0) (12,134) (3.4) (8,714) (2.3)

Actual income tax expense ........ $159,659 35.4% $128,689 35.6% $139,042 36.4%

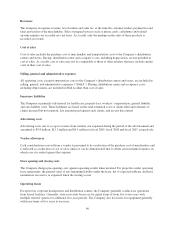

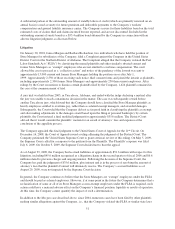

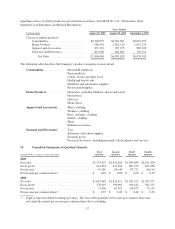

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and

deferred tax liabilities as of the end of fiscal 2009 and the end of fiscal 2008, were as follows:

(in thousands) August 29, 2009 August 30, 2008

Deferred income tax liabilities:

Excess of book over tax basis of property and equipment ..... $ 81,129 $ 73,621

Deferred income tax assets:

Excess of tax over book basis of inventories ................ $ 11,307 $ 14,511

Nondeductible accruals for:

Insurance ....................................... 32,264 30,871

Compensation ................................... 36,964 28,950

Deferred rent .................................... 13,691 14,492

Litigation charge ................................. 16,569 16,569

Other .............................................. 14,120 11,294

Gross deferred income tax assets ............................. 124,915 116,687

Less: valuation allowance .................................. (5,883) (6,350)

Net deferred tax assets ..................................... $119,032 $110,337

The Company had net operating loss carryforwards of $153.1 million as of August 29, 2009, and $172.2 million

as of August 30, 2008, in various states. These carryforwards expire at different intervals up to fiscal year 2029.

Management considers all available evidence in determining the likelihood that a deferred tax asset will not be

realized. As a result, the Company established valuation allowances related to these loss carryforwards.

The Company adopted Financial Accounting Standards Board Interpretation No. 48, “Accounting for

Uncertainty in Income Taxes” (“FIN 48”) effective September 2, 2007. FIN 48 clarifies the accounting for

uncertain income tax positions in an enterprise’s financial statements in accordance with SFAS No. 109,

“Accounting for Income Taxes.” FIN 48 prescribes a minimum recognition threshold a tax position is required to

meet before being recognized in the financial statements. This pronouncement also provides guidance on

derecognition, measurement, classification, interest and penalties, accounting in interim periods, disclosure, and

transition. Effective with the adoption of FIN 48, the Company classifies accrued interest expense and penalties

related to uncertain tax positions as a component of income tax expense. During fiscal 2009 and fiscal 2008,

interest and penalties reduced income tax expense by $0.2 million and $1.4 million, respectively. The reductions

were due to settlements of uncertain tax positions and the expiration of the statute of limitations with respect to

uncertain tax positions.

48