Family Dollar 2009 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2009 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

result in an event of default, which, if not cured or waived, could result in us having to repay our borrowings

before their due dates. If we are forced to refinance these borrowings on less favorable terms, our results of

operations or financial condition could be harmed. In addition, if we are in default under any of our existing or

future debt facilities, we will also not be able to borrow additional amounts under those facilities to the extent

that they would otherwise be available. Our ability to obtain future financing may also be impacted negatively.

Funds associated with auction rate securities may not be liquid or readily available.

Our portfolio of investment securities currently consists of auction rate securities ($166.5 million at fair

value as of August 29, 2009), which are not currently liquid or readily available to convert to cash. We do not

believe that the current liquidity issues related to our auction rate securities will impact our ability to fund our

ongoing business operations, but if the global credit crisis persists or intensifies, it is possible that we will be

required to write down the fair value of our auction rate securities further. If we determine that the decline in the

fair value of our auction rate securities is other than temporary, it would result in an impairment charge being

recognized in our Consolidated Statements of Income, and this charge could be material and could adversely

affect our financial results for the periods in which the charges occur. See Note 2 to the Consolidated Financial

Statements included in this Report for more information on our auction rate securities.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

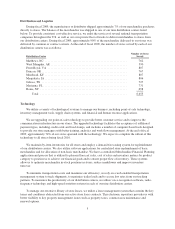

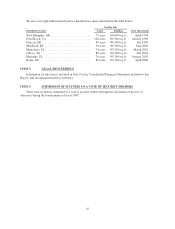

We operate a chain of self-service retail discount stores. As of October 2, 2009, there were 6,664 stores in

44 states and the District of Columbia as follows:

Texas .............................. 841 Arkansas ......................... 101

Ohio ............................... 413 Missouri ......................... 95

Florida ............................. 391 NewMexico ...................... 94

North Carolina ....................... 370 Maryland ........................ 91

Michigan ........................... 349 NewJersey ....................... 78

Georgia ............................. 313 Minnesota ........................ 70

New York ........................... 291 Utah ............................ 59

Pennsylvania ........................ 273 Maine ........................... 51

Louisiana ........................... 228 Connecticut ...................... 49

Illinois ............................. 223 Kansas .......................... 35

Virginia ............................ 215 Iowa ............................ 32

Tennessee ........................... 205 Idaho ............................ 31

South Carolina ....................... 203 Nebraska ......................... 31

Indiana ............................. 195 Nevada .......................... 26

Kentucky ........................... 188 South Dakota ..................... 23

Alabama ............................ 144 NewHampshire ................... 22

Wisconsin ........................... 136 Rhode Island ..................... 22

Arizona ............................. 135 Delaware ........................ 21

Oklahoma ........................... 128 Wyoming ........................ 20

Mississippi .......................... 119 North Dakota ..................... 12

West Virginia ........................ 117 Vermont ......................... 12

Colorado ............................ 105 District of Columbia ................ 3

Massachusetts ........................ 104

14