Family Dollar 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company also maintains a $350 million unsecured revolving credit facility expiring on August 24, 2011.

Any borrowings under this credit facility also accrue interest at a variable rate based on short-term market

interest rates. Outstanding standby letters of credit ($202.3 million as of August 29, 2009) reduce the borrowing

capacity of the $350 million credit facility.

There were no borrowings under the credit facilities during fiscal 2009 compared with $736.3 million borrowed

and repaid during fiscal 2008. The credit facilities contain certain restrictive financial covenants, which include a

consolidated debt to consolidated capitalization ratio, a fixed charge coverage ratio, and a priority debt to

consolidated net worth ratio. As of August 29, 2009, the Company was in compliance with all such covenants.

The estimated fair value of the Company’s long-term debt was $266.2 million as of August 29, 2009, and $238.3

million as of August 30, 2008. The fair value was determined based on a discounted cash flow analysis using

rates available to the Company on debt of the same remaining maturities. The fair value was greater than the

carrying value of the debt by $16.2 million as of August 29, 2009, and less than the carrying value of the debt by

$11.7 million as of August 30, 2008.

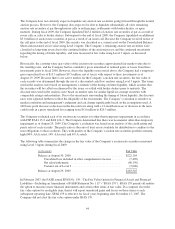

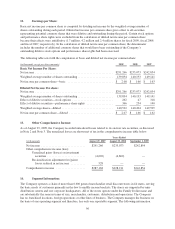

6. Accrued Liabilities:

Accrued liabilities consisted of the following at the end of fiscal 2009 and fiscal 2008:

(in thousands) August 29, 2009 August 30, 2008

Compensation ........................................... $110,035 $ 78,454

Self-insurance liabilities ................................... 210,609 202,829

Taxes other than income taxes ............................... 72,067 76,146

Deferred rent ............................................ 37,733 39,861

Litigation ............................................... 53,330 51,927

Other(1) ................................................. 46,153 47,603

$529,927 $496,820

(1) Other accrued liabilities consist primarily of store utility accruals, certain store rental accruals,

deferred compensation accruals, and accrued interest.

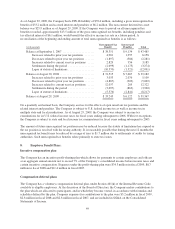

7. Income Taxes:

The provisions for income taxes in fiscal 2009, fiscal 2008 and fiscal 2007 were as follows:

(in thousands) 2009 2008 2007

Current:

Federal ......................................... $137,600 $111,723 $ 79,100

State ........................................... 17,633 10,033 25,399

155,233 121,756 104,499

Deferred:

Federal ......................................... 4,971 1,555 38,074

State ........................................... (545) 5,378 (3,531)

4,426 6,933 34,543

Total ............................................... $159,659 $128,689 $139,042

47