Family Dollar 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

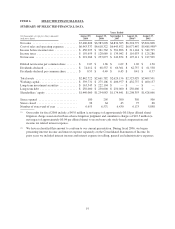

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

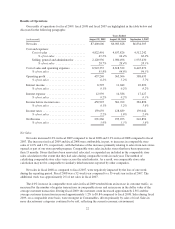

The following discussion summarizes the significant factors affecting our consolidated results of operations

and financial condition for fiscal 2009, fiscal 2008 and fiscal 2007 and our expectations for fiscal 2010. You

should read this discussion in conjunction with our Consolidated Financial Statements and the Notes to

Consolidated Financial Statements, which are included in this Report. Our discussion contains forward-looking

statements which are based upon our current expectations and which involve risks and uncertainties. Actual

results and the timing of events could differ materially from those anticipated in these forward-looking

statements as a result of a number of factors, including those set forth in the “Cautionary Statement Regarding

Forward Looking Statements” in the General Information section of this Report and the “Risk Factors” listed in

Part I, Item 1A of this Report.

Our fiscal year generally ends on the Saturday closest to August 31 of each year, which generally results in

an extra week every six years. Fiscal 2009 and fiscal 2008 were 52-week years compared with a 53-week year in

fiscal 2007. The second quarter of fiscal 2009 and the second quarter of fiscal 2008 included 13 weeks compared

with 14 weeks in the second quarter of fiscal 2007.

Executive Overview

We operate a chain of more than 6,600 general merchandise retail discount stores in 44 states, providing

primarily low to middle income consumers with a selection of competitively priced merchandise in convenient

neighborhood stores. Our merchandise assortment includes consumables, home products, apparel and

accessories, and seasonal and electronics. We sell merchandise at prices that generally range from less than $1 to

$10.

During fiscal 2009 as compared with fiscal 2008, our net sales increased 6.0% to $7.4 billion, our net

income increased 25.0% to $291.3 million, and our diluted net income per common share increased 24.7% to

$2.07. Comparable store sales (stores open more than 13 months) for fiscal 2009 increased 4.0% compared with

fiscal 2008. Our strong results during fiscal 2009 were due primarily to strong sales of consumable merchandise

and improvements in cost of sales, as a percentage of net sales.

Although the economic environment remained difficult for our customers during fiscal 2009, with rapidly

rising unemployment and a decline in average hours worked, we believe our customers benefited from lower

energy costs and certain government stimulus programs. We believe our strategy of providing both value and

convenience continues to resonate well with budget-minded consumers. During fiscal 2009, we experienced an

increase in customer traffic and the dollar value of the average transaction. Our customer research suggests that

our core low-income customer is shopping us more frequently and spending more when they shop at our stores.

In addition, we are seeing growth in the number of shopping trips and average transaction from more middle-

income customers. The various components affecting our results for fiscal 2009 are discussed in more detail

below.

During fiscal 2009, we focused on driving revenues, mitigating risk and managing costs through the

following key initiatives:

• We continued the expansion of our assortment of traffic-driving consumables, providing customers

with more of what they need in a challenging economic environment. During fiscal 2009, we initiated

efforts to re-align space in our stores to accommodate strong customer demand for consumable

merchandise and improve the in-store shopping experience. Approximately 48% of the chain was

impacted by these efforts during fiscal 2009.

• To strengthen the Family Dollar brand with customers and to reinforce the values we offer, we focused

on increasing the productivity and returns of our advertising and customer communications and

improving our in-store execution of promotional events.

20