Family Dollar 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

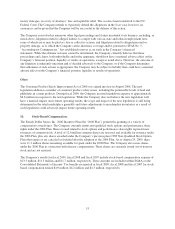

measured based on two pre-tax metrics: Return on Equity and Income Growth. The Compensation Committee of

the Board of Directors establishes the peer group and performance metrics. The performance share rights vest at

the end of the performance period (generally three years) and the shares are issued shortly thereafter. The actual

number of shares issued can range from 0% to 200% of the employee’s target award depending on the

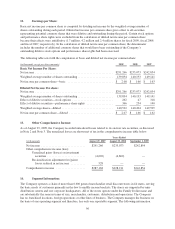

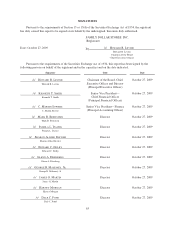

Company’s performance relative to the peer group. The following table summarizes the transactions under the

performance share rights program during fiscal 2009:

(in thousands, except per share amounts)

Performance

Share Rights

Outstanding

Weighted

Average

Grant-Date

Fair Value

Nonvested—August 30, 2008 .................................... 596 $26.87

Granted ..................................................... 277 23.56

Vested ...................................................... (220) 24.29

Cancellations ................................................. (24) 26.83

Adjustments .................................................. 37 N/A

Nonvested—August 29, 2009 .................................... 666 $26.20

The grant-date fair value of the performance share rights is based on the stock price on the grant date. The

weighted-average grant-date fair value of performance share rights granted was $23.56 during fiscal 2009,

$26.96 during fiscal 2008 and $29.40 during fiscal 2007. Compensation cost is recognized on a straight-line

basis, net of estimated forfeitures, over the requisite service period and adjusted quarterly to reflect the ultimate

number of shares expected to be issued. The adjustments of performance share rights outstanding in the table

above represent the performance adjustment for shares vested during the period. The total fair value of

performance share rights vested was $5.3 million during fiscal 2009, $2.3 million during fiscal 2008 and $1.7

million during fiscal 2007. As of August 29, 2009, there was approximately $9.7 million of unrecognized

compensation cost related to outstanding performance share rights, based on the Company’s most recent

performance analysis. The unrecognized compensation cost will be recognized over a weighted-average period of

1.6 years.

11. Stock Repurchases:

During fiscal 2009, the Company purchased 2.3 million shares of its common stock at a cost of $71.1 million.

During fiscal 2008, the Company purchased 3.7 million shares at a cost of $97.7 million, and during fiscal 2007,

the Company purchased 8.2 million shares at a cost of $257.5 million.

All shares are purchased pursuant to share repurchase authorizations approved by the Board of Directors. On

November 5, 2007, the Company announced that the Board of Directors authorized the Company to purchase up

to $150 million of the Company’s common stock from time to time as market conditions warrant. As of

August 29, 2009, the Company had $62.0 million remaining under this authorization. There is no expiration date

governing the period during which share repurchases can be made pursuant to the above referenced

authorization. Shares purchased under the share repurchase authorizations are generally held in treasury or have

been canceled and returned to the status of authorized but unissued shares.

On November 2, 2007, the Company retired 35.8 million shares of its common stock held in treasury. The shares

were returned to the status of authorized but unissued shares. As a result, treasury stock decreased approximately

$758.7 million. In accordance with Accounting Principles Board (APB) Opinion 6, “Status of Accounting

Research Bulletins,” the Company reduced common stock, capital in excess of par, and retained earnings by

approximately $3.6 million, $37.4 million, and $717.7 million, respectively.

55