Energizer 2000 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER 2000 ANNUAL REPORT

48

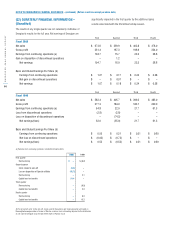

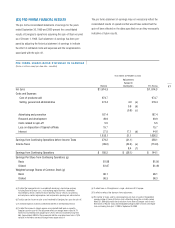

YEAR ENDED SEPTEMBER 30, 1999

Adjustments

Related to

Historic Distribution Pro Forma

Net Sales $ 1,872.3 $ 1,872.3

Costs and Expenses

Cost of products sold 997.9 997.9

Selling, general and administrative 398.0 8.0 (a) 400.9

(3.3) (b)

(1.8) (c)

(d)

Advertising and promotion 164.3 164.3

Research and development 48.5 48.5

Provisions for restructuring 7.8 7.8

Interest 7.6 36.9 (e) 44.5

1,624.1 39.8 1,663.9

Earnings from Continuing Operations before Income Taxes 248.2 (39.8) 208.4

Income Taxes (88.4) (11.2) (f) (91.5)

8.1 (g)

Earnings from Continuing Operations $ 159.8 $ (42.9) $ 116.9

Earnings Per Share from Continuing Operations (h) $ 1.56 $ 1.14

Weighted-average Shares of Common Stock (h) 102.6 102.6

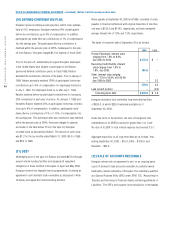

PRO FORMA CONSOLIDATED STATEMENT OF EARNINGS

(Dollars in millions except per share data – unaudited)

(a) To reflect the incremental costs associated with becoming a stand-alone company including

Board of Director costs, stock exchange registration fees, shareholder record keeping

services, external financial reporting, treasury services, tax planning and compliance,

certain legal expenses and compensation planning and administration.

(b) To reflect pension income on plan assets to be transferred to Energizer plans upon

the distribution.

(c) To eliminate expense of certain postretirement benefits to be retained by Ralston.

(d) In addition to costs described above, compensation for certain executive officers will

be higher than the costs included in the historical financial statements. The amount of

the increase cannot be determined at this time.

(e) To reflect the increase in interest expense associated with debt levels to be assumed at

Distribution Date. The adjustment reflects an interest rate of 7.0% for $150.0 of incremental

notes payable and 7.7% for $343.9 of incremental long-term debt. The incremental notes

payable will have a variable interest rate. A 1/8% variation in the interest rate would change

interest expense by $.4.

(f) To reflect taxes as if Energizer was a single, stand-alone U.S. taxpayer.

(g) To reflect tax effect of the above pro forma adjustments.

(h) The number of shares used to compute earnings per share is based on the weighted-

average number of shares of Ralston stock outstanding during the year ended

September 30, 1999, adjusted for the anticipated distribution of one share of Energizer

stock for each three shares of Ralston stock.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued) (Dollars in millions except per share data)