Energizer 2000 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

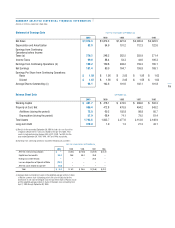

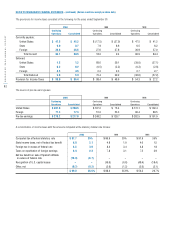

YEAR ENDED SEPTEMBER 30,

2000 1999 1998

Cash Flow from Operations

Net earnings $ 181.4 $ 80.0 $ 164.7

Adjustments to reconcile net earnings to net cash flow from operations:

Depreciation and amortization 82.0 94.9 101.2

Translation and exchange loss 1.9 9.0 10.4

Deferred income taxes 5.9 70.4 (36.6)

Loss on sale of Spanish affiliate 15.7 ––

Non-cash restructuring charges/(reversals) –(2.2) (6.5)

Net (earnings)/loss from discontinued operations (1.2) 79.8 43.5

Sale of accounts receivable 100.0 ––

Changes in assets and liabilities used in operations:

(Increase)/decrease in accounts receivable, net (25.3) (6.4) (34.2)

(Increase)/decrease in inventories (90.8) 22.1 (2.8)

(Increase)/decrease in other current assets 18.7 (13.9) 3.6

Increase/(decrease) in accounts payable 24.2 (21.3) 0.2

Increase/(decrease) in other current liabilities (16.8) 16.2 1.5

Other, net (6.1) 8.6 (12.4)

Cash flow from continuing operations 289.6 337.2 232.6

Cash flow from discontinued operations 54.7 15.1 8.7

Net cash flow from operations 344.3 352.3 241.3

Cash Flow from Investing Activities

Property additions (72.8) (69.2) (102.8)

Proceeds from sale of OEM business 20.0 ––

Proceeds from sale of assets 3.2 1.4 14.1

Other, net (8.7) (0.5) 4.6

Cash used by investing activities – continuing operations (58.3) (68.3) (84.1)

Cash used by investing activities – discontinued operations (0.7) (3.7) (13.2)

Net cash used by investing activities (59.0) (72.0) (97.3)

Cash Flow from Financing Activities

Net cash proceeds from issuance of long-term debt 407.0 1.0 13.8

Principal payments on long-term debt (including current maturities) (449.5) (13.3) (35.1)

Cash proceeds from issuance of notes payables with maturities greater than 90 days 6.1 14.7 10.2

Cash payments on notes payables with maturities greater than 90 days (3.7) (0.1) –

Net increase/(decrease) in notes payable with maturities of 90 days or less (50.2) (12.0) 32.8

Net transactions with Ralston prior to spin-off (210.7) (293.7) (154.7)

Net cash used by financing activities (301.0) (303.4) (133.0)

Effect of Exchange Rate Changes on Cash (0.2) 1.8 (4.6)

Net Increase/(Decrease) in Cash and Cash Equivalents (15.9) (21.3) 6.4

Cash and Cash Equivalents, Beginning of Period 27.8 49.1 42.7

Cash and Cash Equivalents, End of Period $ 11.9 $ 27.8 $ 49.1

Non-cash transactions:

Debt assigned by Ralston $ 478.0 $ – $ –

The above financial statement should be read in conjunction with the Notes to Consolidated Financial Statements.

CONSOLIDATED STATEMENT OF CASH FLOWS

(Dollars in millions)