Energizer 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

NOTES TO CONSOLIDATED FINANCIAL

STATEMENTS

(Dollars in millions except per share data)

(1) BASIS OF PRESENTATION

On June 10, 1999, the Board of Directors of Ralston approved in

principle a plan to spin off its battery business to the Ralston stock-

holders. In September 1999, Energizer Holdings, Inc. (Energizer)

was incorporated in Missouri as an indirect subsidiary of Ralston.

Effective April 1, 2000, Energizer became an independent, publicly

owned company as a result of the distribution by Ralston of

Energizer’s $.01 par value common stock to the Ralston stockholders

at a distribution ratio of one for three (the spin-off). Prior to the

spin-off, Energizer operated as a wholly owned subsidiary of Ralston.

Ralston received a ruling from the Internal Revenue Service stating

the distribution qualified as a tax-free spin-off.

Energizer is the world’s largest publicly traded manufacturer of

primary batteries and flashlights and a global leader in the dynamic

business of providing portable power. Energizer manufactures and

markets a complete line of primary alkaline and carbon zinc batteries

under the brands Energizer e2, Energizer and Eveready, as well as

miniature and rechargeable batteries, and flashlights and other

lighting products. Energizer and its subsidiaries operate 22 manu-

facturing facilities in 15 countries on four continents. Its products

are marketed and sold in more than 140 countries primarily

through a direct sales force, and also through distributors, to

mass merchandisers, wholesalers and other customers.

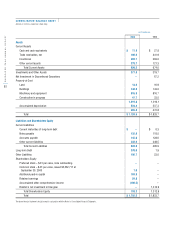

The Balance Sheet as of September 30, 2000 is presented on a

consolidated basis. The Statement of Earnings and Statement of

Cash Flows for the year ended September 30, 2000 include the

combined results of operations of the Energizer businesses under

Ralston for the six months prior to the spin-off and the consolidated

results of operations of Energizer on a stand-alone basis for the

six months ended September 30, 2000. The financial statements

for all periods prior to the spin-off are presented on a combined

basis and reflect periods during which the Energizer businesses

operated as wholly owned subsidiaries of Ralston. The financial

information in these financial statements does not include certain

expenses and adjustments that would have been incurred had

Energizer been a separate, independent company, and may not

necessarily be indicative of results that would have occurred had

Energizer been a separate, independent company during the periods

presented or of future results of Energizer.

(2) SUMMARY OF ACCOUNTING POLICIES

Energizer’s significant accounting policies, which conform to

generally accepted accounting principles in the United States

and are applied on a consistent basis among all years presented,

except as indicated, are described below.

Principles of Consolidation

– These financial statements

include the accounts of Energizer and its majority-owned sub-

sidiaries. All significant intercompany transactions are eliminated.

Investments in affiliated companies, 20% through 50% owned, are

carried at equity. A one-month lag is utilized in reporting all interna-

tional subsidiaries in Energizer’s consolidated financial statements.

Use of Estimates

– The preparation of financial statements in

conformity with generally accepted accounting principles requires

management to make estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contin-

gent assets and liabilities at the date of the financial statements, and

the reported amounts of revenues and expenses during the reporting

period. Actual results could differ from those estimates.

Foreign Currency Translation

– Financial statements of foreign

operations where the local currency is the functional currency are

translated using end-of-period exchange rates for assets and liabili-

ties and average exchange rates during the period for results of

operations. Related translation adjustments are reported as a

component within accumulated other comprehensive income in

the shareholders equity section of the Consolidated Balance Sheet.