Energizer 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

(8) STOCK-BASED COMPENSATION

Energizer’s 2000 Incentive Stock Plan was adopted by the Board of

Directors in March 2000 and is being submitted to shareholders for

their approval, with respect to future awards which may be granted

under the Plan, at the 2001 Annual Meeting of Shareholders. Under

the Plan, awards to purchase shares of Energizer’s common stock

may be granted to directors, officers and key employees. A maxi-

mum of 15.0 million shares of Energizer (ENR) stock was approved

to be issued under the Plan. At September 30, 2000, there were

7.0 million shares available for future awards.

Options which have been granted under the Plan have been granted

at the market price on the grant date and generally vest ratably over

four or five years. Awards have a maximum term of 10 years.

Restricted stock and restricted stock equivalent awards may also

be granted under the Plan. During 2000, the Board of Directors

approved the grants of up to 635,000 restricted stock equivalents to

a group of key employees and directors upon their purchase of an

equal number of shares of ENR stock within a specified period. The

restricted stock equivalents will vest three years from their respective

dates of grant and will convert into unrestricted shares of ENR stock

at that time, or, at the recipient’s election, will convert at the time

of the recipient’s retirement or other termination of employment. As

of September 30, 2000, 488,415 restricted stock equivalents had

been granted. The weighted-average fair value for restricted stock

equivalents granted in 2000 was $18.30.

Under the terms of the Plan, option shares and prices, and restricted

stock and stock equivalent awards, are adjusted in conjunction with

stock splits and other recapitalizations so that the holder is in the

same economic position before and after these equity transactions.

Energizer also permits deferrals of bonus and salary, and, for

directors, retainers and fees, under the terms of its Deferred

Compensation Plan. Under this Plan, employees or directors

deferring amounts into the Energizer Common Stock Unit Fund

are credited with a number of stock equivalents based on the fair

value of ENR stock at the time of deferral. In addition, during 2000,

they were credited with an additional number of stock equivalents

equal to 25% for employees, and 33 1/3% for directors, of the

amount deferred. This additional company match vests immediately

for directors and three years from the date of initial crediting for

employees. Amounts deferred into the Energizer Common Stock

Unit Fund, and vested company matching deferrals, may be trans-

ferred to other investment options offered under the Plan. At the time

of termination of employment, or for directors, at the time of termi-

nation of service on the Board, or at such other time for distribution

which may be elected in advance by the participant, the number of

equivalents then credited to the participant’s account is determined

and then an amount in cash equal to the fair value of an equivalent

number of shares of ENR stock is paid to the participant.

Energizer applies APB 25 and related interpretations in accounting

for its stock-based compensation. Accordingly, charges to earnings

for stock-based compensation were $4.8 in 2000. Had cost for

stock-based compensation been determined based on the fair value

method set forth under SFAS 123, Energizer’s net earnings and earn-

ings per share would have been reduced to the pro forma amounts

indicated in the table below. Pro forma amounts are for disclosure

purposes only and may not be representative of future calculations.

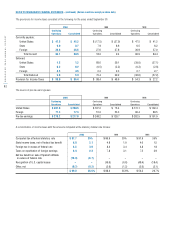

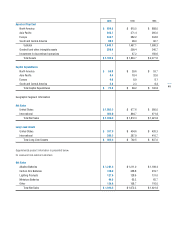

Fiscal 2000

Basic Diluted

Net Earnings Earnings

Earnings per Share per Share

As reported $181.4 $1.89 $1.88

Pro forma $176.1 $1.83 $1.83

The weighted-average fair value for options granted in fiscal 2000

was $7.13 per option. This was estimated at the grant date using the

Black-Scholes option pricing model with the following weighted-

average assumptions:

2000

Risk-free interest rate 5.85%

Expected life of option 7.5 years

Expected volatility of

ENR stock 20.30%

Expected dividend

yield on ENR stock –%