Energizer 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER 2000 ANNUAL REPORT

28

Recently Issued Accounting Pronouncements

–

In June

1998, the Financial Accounting Standards Board (FASB) issued

Statement of Financial Accounting Standards No. 133, “Accounting

for Derivative Instruments and Hedging Activities” (SFAS 133) and

in June 2000, issued Statement of Financial Accounting Standards

No. 138 (SFAS 138), an amendment of SFAS 133. These statements

are effective for all fiscal quarters of fiscal years beginning after

June 15, 2000. The statements require the recognition of derivative

financial instruments on the balance sheet as assets or liabilities,

at fair value. Gains or losses resulting from changes in the value of

derivatives are accounted for depending on the intended use of the

derivative and whether it qualifies for hedge accounting. Accordingly,

Energizer has adopted the provisions of SFAS 133 as of the first

quarter of fiscal year 2001. Energizer has determined that the

implementation of this standard will not have a material effect

on its consolidated financial position or results of operations.

In December 1999, the Securities and Exchange Commission (SEC)

issued Staff Accounting Bulletin (SAB) 101, “Revenue Recognition

in Financial Statements.” SAB 101 provides guidance on recogni-

tion, presentation and disclosure of revenue in financial statements.

In addition, the Emerging Issues Task Force (EITF) issued EITF

00-10 and 00-14. EITF 00-10, “Accounting for Shipping and

Handling Fees and Costs,” provides guidance on earnings statement

classification of amounts billed to customers for shipping and

handling. EITF 00-14, “Accounting for Certain Sales Incentives,”

provides guidance on accounting for discounts, coupon, rebates

and free product. Energizer will be required to adopt SAB 101, EITF

00-10 and EITF 00-14 no later than the fourth quarter of fiscal year

2001. Energizer does not expect the adoption of these statements

to have a material effect on its results of operations, however, certain

reclassifications may be necessary.

In September 2000, FASB issued Statement of Financial Accounting

Standards No. 140, “Accounting for Transfers and Servicing of

Financial Assets and Extinguishments of Liabilities.” The statement

is effective for fiscal years ending after December 15, 2000. The

statement replaces FASB Statement No. 125 and revises the stan-

dards for accounting and disclosure for securitizations and other

transfers of financial assets and collateral. The statement carries

over most of SFAS 125’s provisions without reconsideration and,

as such, Energizer believes that the implementation of this standard

will not have a material effect on its consolidated financial position

or results of operations.

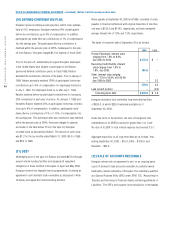

(3) RELATED PARTY ACTIVITY

Cash Management

– Prior to the spin-off, Energizer participated

in a centralized cash management system administered by Ralston.

Cash deposits from Energizer were transferred to Ralston on a daily

basis and Ralston funded Energizer’s disbursement bank accounts

as required. Unpaid balances of checks were included in accounts

payable. No interest was charged or credited on transactions

with Ralston.

Shared Services

– Energizer and Ralston have entered into a

Bridging Agreement under which Ralston has continued to provide

certain general and administrative services to Energizer, including

systems, benefits, advertising and facilities for Energizer’s headquar-

ters. Prior to the spin-off, the expenses related to shared services

listed above, as well as legal and financial support services, were

allocated to Energizer generally based on utilization, which manage-

ment believes to be reasonable. Costs of these shared services

charged to Energizer were $9.6, $20.0 and $20.9 for the six months

ended March 31, 2000 and years ended September 30, 1999 and

1998, respectively. Actual expenses paid by Energizer to Ralston

for such services were $4.0 for the six-month period subsequent

to the spin-off.

Ralston’s Net Investment

–

Included in Ralston’s Net Investment

are cumulative translation adjustments for non-hyperinflationary

countries of $84.6 as of March 31, 2000 representing net devaluation

of currencies relative to the U.S. dollar over the period of investment.

Also included in Ralston’s Net Investment are accounts payable and

receivable between Energizer and Ralston.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued) (Dollars in millions except per share data)