Energizer 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER 2000 ANNUAL REPORT

30

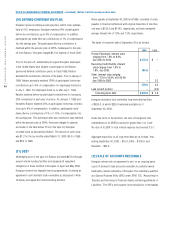

The 1999 restructuring plan provided for the termination of

approximately 170 production and administrative employees and

the closure of one plant in Asia. This plant closure was precipitated

by the financial problems in the Asian market, which resulted

in contractions in battery markets in this area. Substantially all

actions associated with these charges were completed as of

September 30, 2000.

The remaining $2.5 represents additional net provisions related

to prior years’ restructuring plans. Additional termination benefits

of $5.5 related to the 1997 restructuring plan primarily represent

enhanced severance related to a European plant closing. Additional

provisions for other cash costs of $1.8 were recorded for fixed asset

disposition costs for previously held for use assets related to the

1997 restructuring plan that were idled and held for disposal. Other

non-cash charges of $2.1 relate to inventory write-offs, which were

more than offset by a reclassification of $4.5 from other comprehen-

sive income to net income of cumulative translation adjustment for a

subsidiary sold in connection with the 1997 plan. Also recorded in

1999 were asset proceeds greater than anticipated of $5.4 related to

1994, 1995 and 1997 restructuring plans.

During 1998, Energizer recorded net after-tax provisions for restruc-

turing of $12.8, or $21.3 on a pre-tax basis, of which $.3 represents

inventory write-downs and is classified as cost of products sold in

the Consolidated Statement of Earnings. Of the net pre-tax charge,

$36.5 related to 1998 restructuring plans, including a voluntary

early retirement option offered to most U.S. Energizer employees

meeting certain age and service requirements and European

business operations restructuring, primarily a reorganization

of European sales forces and related employee reductions.

The total 1998 pre-tax charge of $36.5 consisted of termination

benefits of $29.3, which provided for the termination or early

retirement of approximately 420 sales and administrative employees,

other cash costs of $4.6, fixed asset impairments of $1.1 and a

non-cash investment write-off of $1.5. The other cash costs of $4.6

consisted of demolition costs of $1.5 and environmental exit costs

of $.8, both relating to assets held for disposal, lease termination

costs of $1.6 and other exit costs of $.7. Except for disposition of

certain assets held for disposal, substantially all actions associated

with the 1998 charges were complete as of September 30, 2000.

In addition, net reversals of $15.2, that related to prior years’

restructuring plans, were recorded in 1998, comprised of $3.7

of additional charges offset by $18.9 of reversals of prior years’

charges. The additional charges primarily related to asset disposi-

tion costs of $2.6 for previously held for use assets that were idled

and held for disposal. The reversals included $9.4 of greater than

anticipated proceeds from asset sales related to the 1994, 1995

and 1996 restructuring plans. In addition, $8.5 of termination

benefits recorded in 1997 were reversed in 1998 due primarily

to the modification of a European plant closing plan, driven by

the changing business environment in Europe. The modifications

resulted in the termination of approximately 200 fewer employees

than originally anticipated.

As of September 30, 2000, except for the disposition of certain

assets held for disposal, substantially all activities associated with

1994 through 1997 restructuring plans are complete. The remaining

accrual related to these plans was $2.1 at September 30, 2000 and

primarily represents asset disposition costs. The carrying value of

assets held for disposal under all restructuring plans was $6.7 at

September 30, 2000.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued) (Dollars in millions except per share data)