Energizer 2000 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

(4) DISCONTINUED OPERATIONS

In March 1999, the Board of Directors of Ralston announced

its intention to exit Energizer’s worldwide rechargeable Original

Equipment Manufacturers’ (OEM) battery business to allow Energizer

to focus on its primary battery business. On November 1, 1999, the

OEM business was sold to Moltech Corporation for approximately

$20.0. This segment is accounted for as a discontinued operation

in Energizer’s consolidated financial statements.

In fiscal 2000, Energizer recognized an after-tax gain of $1.2 on the

disposition of discontinued operations related to the final settlement

of the sale transaction.

Included in the fiscal year 1999 Net Loss on Disposition of

Discontinued Operations are estimated operating losses during

the divestment period of $15.0 pre-tax, or $9.6 after-tax, and a

loss on disposition of $95.6 pre-tax, or $64.6 after-tax. Actual

pre-tax operating losses during the divestment period through

September 30, 1999, totaled $12.5.

The net loss for 1998 includes an after-tax provision of $42.7,

primarily representing an impairment write-down of lithium ion

rechargeable battery assets of the OEM business. Fair value of

those assets was primarily determined based upon estimates of

recovery value for unique manufacturing equipment. Due to rapid

changes in the business environment since the beginning of the

lithium ion project in 1996, it became more economical to source

lithium ion cells from other manufacturers.

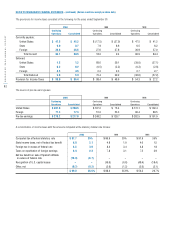

The Investment in Discontinued Operations at September 30, 1999

was primarily comprised of fixed assets, inventory and accounts

receivable and payable. Results for discontinued operations are

presented in the following table.

1999 1998

Net sales $ 64.2 $ 149.4

Earnings/(loss) before

income taxes $ (9.0) $ (70.6)

Income taxes benefit/(provision) 3.4 27.1

Net earnings/(loss) from

discontinued operations $ (5.6) $ (43.5)

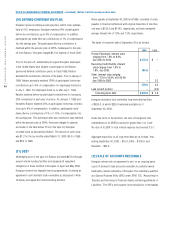

(5) RESTRUCTURING ACTIVITIES

Competition in the primary battery business has intensified in

recent years, and there continues to be a migration of demand from

carbon zinc to alkaline batteries. In response to these changes,

Energizer has recorded restructuring charges each year from 1994

through 1999. These charges include a reduction in carbon zinc

plant capacity as demand for this type of battery continues to

decline, plant closures for the movement and consolidation of

alkaline production to new or more efficient locations in an effort

to achieve lower product costs, and staffing reorganizations and

reductions in various world areas to enhance management effective-

ness and reduce overhead costs. A detailed discussion of such

charges and expenditures during 1998 through 2000 follows.

During 1999, Energizer recorded net provisions for restructuring of

$8.3 after-tax, or $9.9 pre-tax, $2.1 of which represented inventory

write-downs and is classified as cost of products sold in the

Consolidated Statement of Earnings. Of the net pre-tax charge, $7.4

relates to the 1999 restructuring plans for the elimination of certain

production capacity in North America and in Asia.

The pre-tax charge of $7.4 for 1999 plans consisted of termination

benefits of $3.2, other cash costs of $.2 and fixed asset impairments

of $4.0. The fixed asset impairments primarily relate to assets used

for the production of lithium coin cells in North America. These

assets were idled and scrapped in 1999.