Energizer 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER 2000 ANNUAL REPORT

12

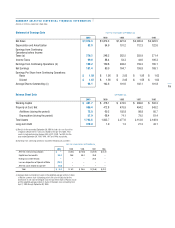

Selling, General and Administrative

Selling, general and administrative expenses decreased $19.3

or 5% in 2000 on lower general corporate expenses, as discussed

below, and decreases in Europe were partially offset by increases

in North American marketing and distribution costs. In 1999,

selling, general and administrative expenses were flat with 1998

as decreases in Europe and South and Central America were

offset by higher general corporate expenses. Selling, general and

administrative expenses were 19.7%, 21.2% and 20.7% of sales

in 2000, 1999 and 1998, respectively.

Advertising and Promotion

Advertising and promotion increased $23.1 or 14% in 2000 reflect-

ing higher spending in North America, partially offset by a decrease

in Europe. In 1999, advertising and promotion decreased $19.3 or

11% with declines in all regions. Advertising and promotion as a

percent of sales was 9.8%, 8.8% and 9.6% in 2000, 1999 and

1998, respectively.

Segment Results

Energizer’s operations are managed via four major geographic

areas – North America (including the United States and Canada),

Asia Pacific, Europe and South and Central America (including

Mexico). This structure is the basis for Energizer’s reportable operat-

ing segment information presented in Note 21 to the Consolidated

Financial Statements. Energizer evaluates segment profitability based

on operating profit before general corporate expenses, research and

development expenses, restructuring charges and amortization of

goodwill and intangibles. Intersegment sales are generally valued

at market-based prices and represent the difference between total

sales and external sales as presented in Note 21 to the Consolidated

Financial Statements. Segment profitability includes profit on these

intersegment sales.

North America

Net sales increased $86.1 or 8% in 2000 on

higher volume, partially offset by unfavorable pricing and product

mix. Alkaline unit volume increased 11% over 1999. Strong Y2K-

driven demand early in the fiscal year and incremental Energizer e 2

sales in the last four months of the year account for the increased

volume. Gross margin increased $53.7 with volume contributing

$45.8. In addition, favorable production costs were partially offset

by unfavorable pricing and product mix. Segment profit increased

$20.5 or 7% as higher gross margin was partially offset by

increased advertising and promotion of $27.6, primarily related

to the Energizer e 2launch, as well as higher marketing and

distribution expenses.

Net sales increased $30.5 or 3% in 1999. Volume contributed

$55.2 of the sales increase, partially offset by unfavorable pricing

and product mix. Alkaline volume increased 8% in 1999. Segment

profit for North America increased $11.6 or 4% in 1999 as a result

of the higher gross margin associated with the increase in sales.

Increased marketing and distribution costs of $5.0 and increased

general and administrative expenses of $4.4 were largely offset by

an $8.4 decrease in advertising and promotion expenditures.

Asia Pacific

Net sales to customers increased $8.4 or 2% in

2000. Excluding currency devaluations of $4.3, net sales increased

$12.7 or 3%. Alkaline volume increases of 8% were partially offset

by a 2% decline in carbon zinc volume. Segment profit for Asia

Pacific increased $22.7 or 25%, in 2000. Gross margin increased

$23.3 due to lower production costs, higher customer sales and

higher intersegment sales. Lower production costs reflect a variety

of factors including higher production facility utilization and lower

costs resulting from a plant closing in 1999. Selling, general and

administrative expenses were up 1% compared to 1999.

Net sales decreased $12.1 or 3% in 1999. Currency devaluations

accounted for $12.0 of the sales decline. Carbon zinc volume

decreases of 5% were offset by a 4% increase in alkaline volume.

Segment profit for Asia Pacific decreased $11.1 or 11% in 1999.

Gross margin declined $21.3 due to higher production costs

and lower sales. Partially offsetting these declines were a $6.2

decrease in exchange losses and a $4.0 decrease in advertising

and promotion.

Europe

Net sales to customers for Europe decreased $44.3 or 14%

in 2000 reflecting currency devaluation of $28.2, lower carbon zinc

volume of $11.8 and unfavorable pricing and product mix of $6.9,

partially offset by a 1% alkaline volume gain. For the year, carbon

zinc unit volume declined 14%. Gross margin decreased $21.0,

primarily on unfavorable currency impacts of $18.3. The remaining

decline reflects lower sales, partially offset by lower production costs

associated with increased efficiencies following a plant closing in