Energizer 2000 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER 2000 ANNUAL REPORT

10

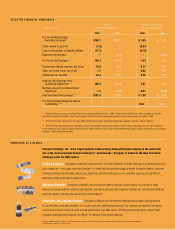

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF RESULTS OF OPERATIONS

AND FINANCIAL CONDITION

(Dollars in millions except per share and percentage data)

The following discussion is a summary of the key factors manage-

ment considers necessary in reviewing Energizer Holdings Inc.’s

(Energizer) historical basis results of operations, operating segment

results, liquidity and capital resources. This discussion should be

read in conjunction with the Consolidated Financial Statements

and related notes.

BASIS OF PRESENTATION

Prior to April 1, 2000, Energizer was a wholly owned subsidiary

of Ralston Purina Company (Ralston). On that date, Ralston

distributed the common stock of Energizer to its shareholders

in a tax-free spin-off.

The Balance Sheet as of September 30, 2000 is presented on a

consolidated basis. The Statement of Earnings and Statement of

Cash Flows for the year ended September 30, 2000 include the

combined results of operations of the Energizer businesses under

Ralston for the six months prior to the spin-off and the consolidated

results of operations of Energizer on a stand-alone basis for the

six months ended September 30, 2000. The financial statements for

all periods prior to the spin-off are presented on a combined basis

and reflect periods during which the Energizer businesses operated

as wholly owned subsidiaries of Ralston. The financial information

in these financial statements does not include certain expenses

and adjustments that would have been incurred had Energizer been

a separate, independent company, and may not necessarily be

indicative of results that would have occurred had Energizer been

a separate, independent company during the periods presented

or of future results of Energizer. See Pro Forma Statement of

Earnings for the years ended September 30, 2000 and 1999 in

Note 23 to the Consolidated Financial Statements.

BUSINESS OVERVIEW

Energizer is the world’s largest publicly traded manufacturer of

primary batteries and flashlights and a global leader in the dynamic

business of providing portable power. Energizer manufactures and

markets a complete line of primary alkaline and carbon zinc batteries

primarily under the brands Energizer e 2, Energizer and Eveready,

as well as miniature and rechargeable batteries, and flashlights and

other lighting products. Energizer and its subsidiaries operate 22

manufacturing facilities in 15 countries on four continents. Its prod-

ucts are marketed and sold in more than 140 countries primarily

through a direct sales force, and also through distributors, to mass

merchandisers, wholesalers and other customers.

There has been a continuing shift within primary battery products

from carbon zinc batteries to alkaline batteries. As such, Energizer

has recorded provisions related to restructuring its worldwide battery

production capacity and certain administrative functions in 1998

and 1999. Alkaline batteries are now the dominant primary battery

in all world areas with the exception of Asia and Africa. Energizer

continues to review its battery production capacity and its business

structure in light of pervasive global trends, including the evolution

of technology.

Energizer’s operations are managed via four major geographic

areas – North America (including the United States and Canada),

Asia Pacific, Europe and South and Central America (including

Mexico). Segment profit and sales are concentrated in the North

America and Asia Pacific areas which together account for 97%

and 79%, respectively, of 2000 segment profit and sales.

The battery business is highly competitive, both in the United States

and on a global basis, as a number of large battery manufacturers

compete for consumer acceptance and limited retail shelf space.

According to A.C. Nielsen, Energizer’s dollar share of the U.S.

alkaline battery market was 34.0% in 1998, 31.2% in 1999 and

32.9% in 2000.

The primary battery category experienced unprecedented growth

levels in the first quarter of fiscal 2000, particularly in the North

America and Asia Pacific regions, related to increased demand

from retail customers and consumers in anticipation of potential

disruptions related to the date change on January 1, 2000.

According to A. C. Nielsen, the alkaline dollar sales for October

through December in the United States increased 28% over the

same quarter last year, compared to historical growth trends in the

high single digits. As the category returns to normal growth trends,

consumer take away will likely decline in the first quarter of fiscal