Energizer 2000 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

restructuring plans. In addition, $8.5 of termination benefits

recorded in 1997 were reversed in 1998, due primarily to the

modification of a European plant closing plan, driven by the

changing business environment in Europe. The modifications

resulted in the termination of approximately 200 fewer employees

than originally anticipated.

Annual pre-tax cost savings from the 1999 restructuring plans

have been or are expected to be as follows: 2000 – $.3 and $1.4

thereafter. Annual pre-tax cost savings from the 1998 restructuring

plans have been or are expected to be as follows: 1999 – $12.0;

2000 and thereafter – $13.0. Annual pre-tax cost savings from the

1997 restructuring plans have been or are expected to be as follows:

1998 – $9.0; 1999 – $19.0; 2000 and thereafter – $23.0.

As of September 30, 2000, except for the disposition of certain

assets held for disposal, substantially all activities associated with

1994 through 1997 restructuring plans are complete. The remaining

accrual related to these plans was $2.1 at September 30, 2000 and

primarily represents asset disposition costs. The carrying value of

assets held for disposal under all restructuring plans was $6.7 at

September 30, 2000.

Energizer expects to fund the remaining costs of these restructuring

actions with funds generated from operations.

See Note 5 to the Consolidated Financial Statements for a table

which presents, by major cost component and by year of provision,

activity related to the restructuring charges discussed above during

fiscal years 2000, 1999 and 1998, including any adjustments to the

original charges.

Interest and Other Financial Items

Interest expense increased $19.9 in 2000 primarily in the last six

months of the year reflecting incremental debt assumed by Energizer

immediately prior to the spin-off. Interest expense decreased $3.5 in

1999 compared to 1998 primarily due to lower rates on foreign debt.

Other financing-related costs were favorable $4.3 in 2000 compared

to 1999 primarily due to lower foreign exchange losses partially

offset by the discount on the sale of accounts receivable financing

arrangement. Other financing costs were unfavorable $6.0 in 1999

compared to 1998 primarily due to higher foreign exchange losses

in 1999.

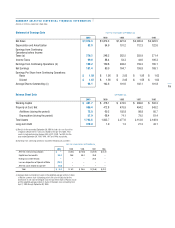

Income Taxes

Income taxes, which include federal, state and foreign taxes, were

35.5%, 35.6% and 20.7% of earnings from continuing operations

before income taxes in 2000, 1999 and 1998, respectively. Income

taxes include certain unusual items in all years, the most significant

of which are described below:

• In 2000, the income tax percentage was favorably impacted by

the recognition of $24.4 of U.S. capital loss tax benefits related

to the disposition of Energizer’s Spanish affiliate.

• Capital loss tax benefits of $16.6 and $48.4 were recognized in

1999 and 1998, respectively, and were primarily related to prior

years’ restructuring actions.

• In 1999, the income tax percentage was unfavorably impacted by

pre-tax restructuring provisions that did not result in tax benefits

due to tax loss situations or particular statutes of a country.

Excluding unusual items, the income tax percentage was 41.8% in

2000, 41.3% in 1999 and 39.2% in 1998.

LIQUIDITY AND CAPITAL RESOURCES

Cash flows from continuing operations totaled $289.6 in 2000,

$337.2 in 1999 and $232.6 in 1998. The 14% decrease in cash

flows from continuing operations in 2000 is due primarily to

increased inventory levels and the realization of capital loss tax

benefits in fiscal 1999, partially offset by higher cash earnings and

proceeds from the sale of accounts receivable. The 45% increase in

cash flows from continuing operations in 1999 resulted primarily

from higher cash earnings and also from favorable changes in

working capital items.

Working capital was $401.7 and $478.1 at September 30, 2000

and 1999, respectively. Capital expenditures totaled $72.8, $69.2

and $102.8 in 2000, 1999 and 1998, respectively. These expendi-

tures were primarily funded by cash flow from operations. Capital

expenditures of approximately $90.0 are anticipated in 2001 and

are expected to be financed with funds generated from operations.

Net transactions with Ralston, prior to the spin-off, resulted in

cash usage of $210.7, $293.7 and $154.7 in 2000, 1999 and

1998, respectively.