Energizer 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER 2000 ANNUAL REPORT

26

For foreign operations where the U.S. dollar is the functional currency

and for countries which are considered highly inflationary, transla-

tion practices differ in that inventories, properties, accumulated

depreciation and depreciation expense are translated at historical

rates of exchange, and related translation adjustments are included

in earnings. Gains and losses from foreign currency transactions

are generally included in earnings.

Financial Instruments

– Energizer uses financial derivatives in

the management of foreign currency and interest-rate risks that are

inherent to its business operations. Such instruments are not held

or issued for trading purposes.

Foreign exchange (F/X) instruments, including currency forwards,

purchased options and zero-cost option collars, are used primarily

to reduce transaction exposures associated with anticipated inter-

company purchases and intercompany borrowings and, to a lesser

extent, to manage other transaction and translation exposures.

F/X instruments used are selected based on their risk reduction

attributes and the related market conditions. The terms of such

instruments are generally 12 months or less.

Realized and unrealized gains and losses from F/X instruments

that hedge firm commitments are deferred as part of the cost basis

of the asset or liability being hedged and are recognized in the

Consolidated Statement of Earnings in the same period as the

underlying transaction. Realized and unrealized gains or losses from

F/X instruments used as hedges of existing balance sheet exposures

or anticipated transactions that are not firmly committed are recog-

nized currently in selling, general and administrative expenses in the

Consolidated Statement of Earnings. However, gains or losses from

F/X instruments that hedge existing balance sheet exposures are

offset in the Consolidated Statement of Earnings by gains or losses

recorded on these hedged exposures. Premiums or discounts on

foreign exchange forward contracts are recognized, and premiums

paid for purchased options are amortized, over the life of the related

F/X instrument in selling, general and administrative expenses in

the Consolidated Statement of Earnings. Unrealized gains and

losses, if any, on zero-cost option collars are deferred as part of the

cost basis of the asset or liability being hedged. F/X instruments are

generally not disposed of prior to settlement date; however, if an F/X

instrument and the underlying hedged transaction were disposed

of prior to the settlement date, any deferred gain or loss would be

recognized immediately in the Consolidated Statement of Earnings.

Cash Equivalents

– For purposes of the Consolidated Statement

of Cash Flows, cash equivalents are considered to be all highly

liquid investments with a maturity of three months or less when

purchased.

Inventories

– Inventories are valued at the lower of cost or market,

with cost generally being determined using average cost or the

first-in, first-out (FIFO) method.

Capitalized Software Costs

– Capitalized software costs are

included in Investments and Other Assets. These costs are amortized

using the straight-line method over periods of related benefit rang-

ing from three to seven years.

Property at Cost

– Expenditures for new facilities and expendi-

tures that substantially increase the useful life of property, including

interest during construction, are capitalized. Maintenance, repairs

and minor renewals are expensed as incurred. When property is

retired or otherwise disposed of, the related cost and accumulated

depreciation are removed from the accounts and gains or losses

on the disposition are reflected in earnings.

Depreciation

– Depreciation is generally provided on the

straight-line basis by charges to costs or expenses at rates based

on the estimated useful lives. Estimated useful lives range from

three to 25 years for machinery and equipment and 10 to 50 years

for buildings. Depreciation expense was $57.9, $68.4 and $74.1

in 2000, 1999 and 1998, respectively.

Goodwill and Other Intangible Assets

– Amortization of

goodwill, representing the excess of cost over the net tangible assets

of acquired businesses, is recorded on a straight-line basis primarily

over a period of 25 years, with some amounts being amortized over

40 years. The cost to purchase or develop other intangible assets,

which consist primarily of patents, tradenames and trademarks, is

amortized on a straight-line basis over estimated periods of related

benefit ranging from seven to 40 years.

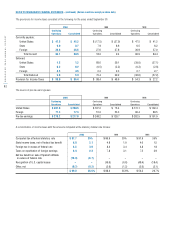

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (continued) (Dollars in millions except per share data)