Energizer 2000 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2000 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

2001 relative to the same quarter last year. In addition, retail inven-

tory levels at December 31, 1999, were above historical norms due

to Y2K-driven ordering which further increased Energizer’s sales in

the first quarter of fiscal 2000. As such, Energizer anticipates report-

ing significantly lower year over year sales for its first fiscal quarter

of 2001.

The Asia Pacific area experienced significant currency devaluations

and economic contraction in 1998 and early 1999, with more stable

trends emerging more recently in most markets. Changes in the

value of local currencies or economic contractions in this area

may continue to impact segment profitability. In particular, recent

currency declines in Australia, New Zealand and the Philippines

have been unfavorable to Energizer during 2000 and into 2001. The

euro and certain other European currencies are at or near historical

low points relative to the U.S. dollar. Currency devaluation was a

significant unfavorable factor in 2000 and continues into 2001.

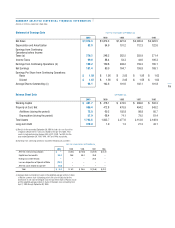

HIGHLIGHTS

Net earnings were $181.4 for the year ended September 30, 2000,

compared to $80.0 in 1999. Earnings per share were $1.89 and

$1.88 on a basic and diluted basis, respectively, compared to

earnings per basic and diluted share of $.78 in the prior year.

Included in net earnings are earnings from continuing operations

of $180.2 and $159.8 in 2000 and 1999, respectively. Current

year net earnings include a net gain on disposition of discontinued

operations of $1.2 related to the final settlement of the sale of

discontinued operations. Fiscal 1999 results include a net loss from

discontinued operations of $5.6 and a net loss on the disposition of

discontinued operations of $74.2.

Net earnings were $164.7, or $1.62 per basic and diluted share, for

the year ended September 30, 1998. Included in 1998 net earnings

are earnings from continuing operations of $208.2 and a net loss

from discontinued operations of $43.5.

Earnings from continuing operations increased $20.4, or $.32 and

$.31 per basic and diluted share, respectively, in 2000. Included in

2000 results are costs related to the spin-off of $5.5 pretax, $3.3

after-tax, loss on disposition of Spanish affiliate of $15.7, and capi-

tal loss tax benefits of $24.4. Fiscal 1999 results include provisions

for restructuring of $9.9 pretax, $8.3 after-tax, and capital loss tax

benefits of $16.6. Excluding these items, earnings from continuing

operations increased $23.3, or $.35 and $.34 per basic and diluted

share, respectively, in 2000. This increase is primarily attributable

to improved operating results in North America and Asia Pacific and

lower corporate overhead, partially offset by higher interest expense

on the debt assumed as part of the spin-off from Ralston.

Earnings from continuing operations decreased $48.4, or $.49

per basic and diluted share, in 1999. Included in both periods are

provisions for restructuring and capital loss tax benefits. Excluding

these items, earnings from continuing operations decreased $21.1,

or $.22 per basic and diluted share, in 1999. This decrease is pri-

marily attributable to declines in the Europe and Asia Pacific areas

partially offset by increases in North America.

Discontinued operations consist of Energizer’s worldwide recharge-

able Original Equipment Manufacturers’ (OEM) battery business.

In March 1999, the Board of Directors of Ralston announced its

intention to exit this business to allow Energizer to focus on its

primary battery business. On November 1, 1999, this business

was sold to Moltech Corporation for approximately $20.0.

OPERATING RESULTS

Net Sales

Net sales increased $42.0 or 2% in 2000 compared to 1999

primarily on growth in North America, partially offset by declines

in Europe. In 1999, sales decreased $49.5 or 3% as declines in

Europe and, to a lesser extent, the Asia Pacific and South and

Central America regions were partially offset by increases in North

America. See comments on sales changes by region in the Segment

Results section below.

Gross Margin

Gross margin dollars increased $65.2 or 7% in 2000 on increases

in North America and Asia Pacific, partially offset by declines in

Europe. Gross margin percentage improved 2.4 percentage points

in 2000 to 49.1% on higher volume and lower production costs in

North America and Asia as well as lower costs in South and Central

America. Gross margin dollars declined $43.0 or 5% in 1999 on

lower sales and lower margin percentage. The margin percentage in

1999 was off 1.0 percentage point to 46.7% compared to 1998 with

decreases in all regions except North America.