Dish Network 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

79

79

Northstar Wireless and SNR Wireless have made the final payments to the FCC for the AWS-3 licenses, our total

non-controlling equity and debt investments in these entities and their parent companies, respectively, will be

approximately $9.778 billion. We have funded and will fund these investments from existing cash and marketable

investment securities. Such funding has included and will include $899 million in total equity and debt investments

in the Northstar Entities and SNR Entities during the fourth quarter 2014, cash and marketable investment securities

as of December 31, 2014, cash generated from operations during 2015, and a $400 million refund from the FCC to

one of our wholly-owned subsidiaries related to the AWS-3 Auction. Under the applicable accounting guidance in

ASC 810, Northstar Spectrum and SNR Holdco are considered variable interest entities and, based on the

characteristics of the structure of these entities and in accordance with the applicable accounting guidance, we have

consolidated these entities into our financial statements beginning in the fourth quarter 2014. See Note 2 in the Notes

to our Consolidated Financial Statements in this Annual Report on Form 10-K for further discussion.

In the event that the FCC grants the Northstar Licenses and the SNR Licenses, we may need to make significant

additional loans to the Northstar Entities and the SNR Entities, or they may need to partner with others, so that the

Northstar Entities and the SNR Entities may commercialize, build-out and integrate the Northstar Licenses and the

SNR Licenses, and comply with regulations applicable to the Northstar Licenses and the SNR Licenses. Depending

upon the nature and scope of such commercialization, build-out, integration efforts, and regulatory compliance, any

such loans or partnerships could vary significantly. There can be no assurance that we will be able to obtain a

profitable return on our non-controlling investments in the Northstar Entities and the SNR Entities.

See Note 16 “Commitments and Contingencies – Wireless Spectrum” in the Notes to our Consolidated Financial

Statements in this Annual Report on Form 10-K for further discussion.

Satellite Insurance

We generally do not carry commercial insurance for any of the in-orbit satellites that we use, other than certain

satellites leased from third parties. We generally do not use commercial insurance to mitigate the potential financial

impact of launch or in-orbit failures because we believe that the cost of insurance premiums is uneconomical relative

to the risk of such failures. We lease substantially all of our satellite capacity from third parties, including the vast

majority of our transponder capacity from EchoStar, and we do not carry commercial insurance on any of the

satellites that we lease from them. While we generally have had in-orbit satellite capacity sufficient to transmit our

existing channels and some backup capacity to recover the transmission of certain critical programming, our backup

capacity is limited. In the event of a failure or loss of any of our satellites, we may need to acquire or lease

additional satellite capacity or relocate one of our other satellites and use it as a replacement for the failed or lost

satellite.

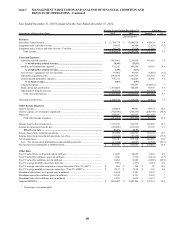

Purchase Obligations

Our 2015 purchase obligations primarily consist of binding purchase orders for receiver systems and related

equipment, broadband equipment, digital broadcast operations, engineering services, and products and services

related to the operation of our DISH branded pay-TV service. Our purchase obligations also include certain fixed

contractual commitments to purchase programming content. Our purchase obligations can fluctuate significantly

from period to period due to, among other things, management’s control of inventory levels, and can materially

impact our future operating asset and liability balances, and our future working capital requirements.

Programming Contracts

In the normal course of business, we enter into contracts to purchase programming content in which our payment

obligations are generally contingent on the number of subscribers to whom we provide the respective content.

These programming commitments are not included in the “Contractual obligations and off-balance sheet

arrangements” table above. The terms of our contracts typically range from one to ten years with annual rate

increases. Our programming expenses will continue to increase to the extent we are successful growing our subscriber

base. In addition, our margins may face further downward pressure from price increases and the renewal of long

term programming contracts on less favorable pricing terms.