Dish Network 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-22

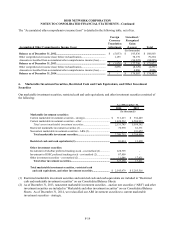

us and a right to require EchoStar to repurchase the Tracking Stock in connection with a change of control of

EchoStar, in each case subject to certain terms and conditions); certain registration rights; certain obligations to

provide conversion and exchange rights of the Tracking Stock under certain circumstances; and certain protective

covenants afforded to holders of the Tracking Stock. The Investor Rights Agreement generally will terminate with

respect to our interest should we no longer hold any shares of the HSSC-issued Tracking Stock and any registrable

securities under the Investor Rights Agreement.

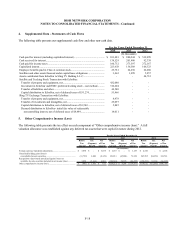

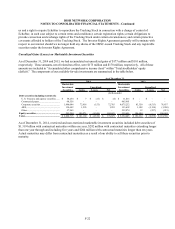

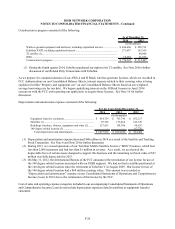

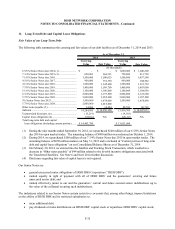

Unrealized Gains (Losses) on Marketable Investment Securities

As of December 31, 2014 and 2013, we had accumulated net unrealized gains of $177 million and $181 million,

respectively. These amounts, net of related tax effect, were $175 million and $178 million, respectively. All of these

amounts are included in “Accumulated other comprehensive income (loss)” within “Total stockholders’ equity

(deficit).” The components of our available-for-sale investments are summarized in the table below.

Marketable Marketable

Investment Investment

Securities Gains Losses Net Securities Gains Losses Net

Debt securities (including restricted):

U. S. Treasury and agency securities....... 58,254$ 7$ (11)$ (4)$ 11,015$ -$ -$ -

Commercial paper.................................... 68,556 - - - 465,981 - - -

Corporate securities................................. 1,496,044 72,918 (153) 72,765 4,075,232 83,350 (4,513) 78,837

ARS.......................................................... 134,642 1,293 - 1,293 133,652 1,188 (5,138) (3,950)

Other........................................................ 57,965 - - - 232,874 12 (227) (215)

Equity securities......................................... 393,254 106,971 (4,346) 102,625 335,651 106,684 - 106,684

Total............................................................ 2,208,715$ 181,189$ (4,510)$ 176,679$ 5,254,405$ 191,234$ (9,878)$ 181,356$

As of December 31,

(In thousands)

Unrealized

2014

Unrealized

2013

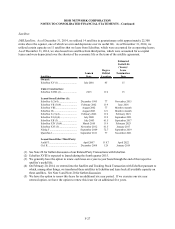

As of December 31, 2014, restricted and non-restricted marketable investment securities included debt securities of

$1.319 billion with contractual maturities within one year, $292 million with contractual maturities extending longer

than one year through and including five years and $204 million with contractual maturities longer than ten years.

Actual maturities may differ from contractual maturities as a result of our ability to sell these securities prior to

maturity.