Dish Network 2014 Annual Report Download - page 67

Download and view the complete annual report

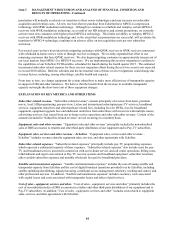

Please find page 67 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

57

57

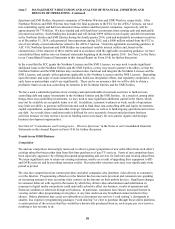

You should read the following management’s discussion and analysis of our financial condition and results of

operations together with the audited consolidated financial statements and notes to our financial statements

included elsewhere in this Annual Report. This management’s discussion and analysis is intended to help provide

an understanding of our financial condition, changes in financial condition and results of our operations and

contains forward-looking statements that involve risks and uncertainties. The forward-looking statements are not

historical facts, but rather are based on current expectations, estimates, assumptions and projections about our

industry, business and future financial results. Our actual results could differ materially from the results

contemplated by these forward-looking statements due to a number of factors, including those discussed in this

report, including under the caption “Item 1A. Risk Factors” in this Annual Report on Form 10-K. Furthermore,

such forward-looking statements speak only as of the date of this Annual Report on Form 10-K and we expressly

disclaim any obligation to update any forward-looking statements.

Overview

Our business strategy is to be the best provider of video services in the United States by providing products with the

best technology, outstanding customer service, and great value. We promote DISH branded programming packages

as providing our subscribers with a better “price-to-value” relationship than those available from other subscription

television service providers. We believe that there continues to be unsatisfied demand for high-quality, reasonably

priced subscription television services.

We generate revenue primarily by providing pay-TV programming and broadband services to our subscribers. We also

generate revenue from pay-TV equipment rental fees and other hardware related fees, including fees for DVRs, fees

for broadband equipment, equipment upgrade fees and additional outlet fees from subscribers with receivers with

multiple tuners; advertising services; and fees earned from our in-home service operations. Our most significant

expenses are subscriber-related expenses, which are primarily related to programming, subscriber acquisition costs and

depreciation and amortization.

Financial Highlights

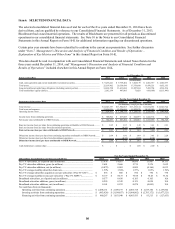

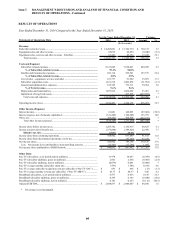

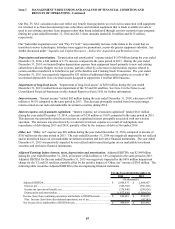

2014 Consolidated Results of Operations and Key Operating Metrics

Revenue of $14.643 billion

Pay-TV ARPU of $83.77

Net income attributable to DISH Network of $945 million and basic earnings per share of common stock of

$2.05

Gross new Pay-TV subscriber activations of approximately 2.601 million

Loss of approximately 79,000 net Pay-TV subscribers

Pay-TV subscriber churn rate of 1.59%

Addition of approximately 141,000 net broadband subscribers

Consolidated Financial Condition as of December 31, 2014

Cash, cash equivalents and current marketable investment securities of $9.236 billion

Total assets of $22.107 billion

Total long-term debt and capital lease obligations of $14.464 billion

Business Segments

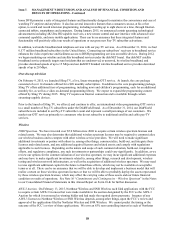

DISH

Our DISH branded pay-TV service (“DISH”) had 13.978 million subscribers in the United States as of December 31,

2014 and is the nation’s third largest pay-TV provider. The majority of our current revenue and profit is derived from

providing pay-TV services. Competition in the pay-TV industry has intensified in recent years. To differentiate

ourselves from our competitors, we introduced the Hopper whole-home DVR during 2012 and have continued to add

functionality and simplicity for a more intuitive user experience. Our current generation Hopper and Joey® whole-