Dish Network 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

76

76

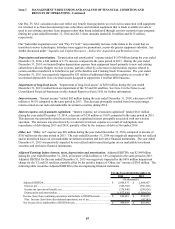

Operational Liquidity

Like many companies, we make general investments in property such as satellites, set-top boxes, information

technology and facilities that support our overall business. However, since we are primarily a subscriber-based

company, we also make subscriber-specific investments to acquire new subscribers and retain existing subscribers.

While the general investments may be deferred without impacting the business in the short-term, the subscriber-

specific investments are less discretionary. Our overall objective is to generate sufficient cash flow over the life of

each subscriber to provide an adequate return against the upfront investment. Once the upfront investment has been

made for each subscriber, the subsequent cash flow is generally positive.

There are a number of factors that impact our future cash flow compared to the cash flow we generate at a given

point in time. The first factor is our Pay-TV churn rate and how successful we are at retaining our current Pay-TV

subscribers. As we lose Pay-TV subscribers from our existing base, the positive cash flow from that base is

correspondingly reduced. The second factor is how successful we are at maintaining our subscriber-related margins.

To the extent our “Subscriber-related expenses” grow faster than our “Subscriber-related revenue,” the amount of

cash flow that is generated per existing subscriber is reduced. The third factor is the rate at which we acquire new

subscribers. The faster we acquire new subscribers, the more our positive ongoing cash flow from existing

subscribers is offset by the negative upfront cash flow associated with acquiring new subscribers. Finally, our future

cash flow is impacted by the rate at which we make general investments and any cash flow from financing activities.

Our subscriber-specific investments to acquire new subscribers have a significant impact on our cash flow. While

fewer subscribers might translate into lower ongoing cash flow in the long-term, cash flow is actually aided, in the

short-term, by the reduction in subscriber-specific investment spending. As a result, a slow-down in our business

due to external or internal factors does not introduce the same level of short-term liquidity risk as it might in other

industries.

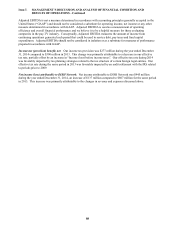

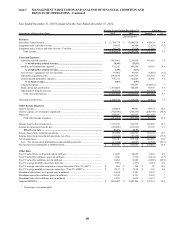

Subscriber Base

DISH lost approximately 79,000 net Pay-TV subscribers during the year ended December 31, 2014, compared to the

addition of approximately 1,000 net Pay-TV subscribers during the same period in 2013. The decrease in net Pay-

TV subscriber additions versus the same period in 2013 primarily resulted from lower gross new Pay-TV subscriber

activations and programming interruptions in connection with the scheduled expiration of certain programming

carriage contracts with several content providers. See “Results of Operations” above for further discussion.

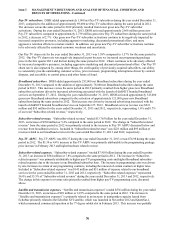

Satellites

Operation of our pay-TV service requires that we have adequate satellite transmission capacity for the programming

we offer. Moreover, current competitive conditions require that we continue to expand our offering of new

programming. While we generally have had in-orbit satellite capacity sufficient to transmit our existing channels

and some backup capacity to recover the transmission of certain critical programming, our backup capacity is

limited. In the event of a failure or loss of any of our owned or leased satellites, we may need to acquire or lease

additional satellite capacity or relocate one of our other satellites and use it as a replacement for the failed or lost

satellite. Such a failure could result in a prolonged loss of critical programming or a significant delay in our plans to

expand programming as necessary to remain competitive and cause us to expend a significant portion of our cash to

acquire or lease additional satellite capacity.

Security Systems

Increases in theft of our signal or our competitors’ signals could, in addition to reducing gross new subscriber

activations, also cause subscriber churn to increase. We use Security Access Devices in our receiver systems to

control access to authorized programming content. Our signal encryption has been compromised in the past and

may be compromised in the future even though we continue to respond with significant investment in security

measures, such as Security Access Device replacement programs and updates in security software, that are intended

to make signal theft more difficult. It has been our prior experience that security measures may only be effective for

short periods of time or not at all and that we remain susceptible to additional signal theft. We expect that future

replacements of Security Access Devices will be necessary to keep our system secure. We cannot ensure that we