Dish Network 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

67

67

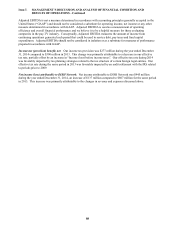

Our Pay-TV SAC calculation does not reflect any benefit from payments we received in connection with equipment

not returned to us from disconnecting lease subscribers and returned equipment that is made available for sale or

used in our existing customer lease program rather than being redeployed through our new customer lease program.

During the years ended December 31, 2014 and 2013, these amounts totaled $110 million and $135 million,

respectively.

Our “Subscriber acquisition costs” and “Pay-TV SAC” may materially increase in the future to the extent that we

transition to newer technologies, introduce more aggressive promotions, or provide greater equipment subsidies. See

further discussion under “Liquidity and Capital Resources – Subscriber Acquisition and Retention Costs.”

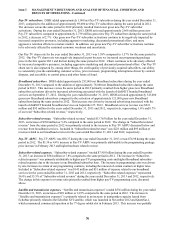

Depreciation and amortization. “Depreciation and amortization” expense totaled $1.078 billion during the year ended

December 31, 2014, a $24 million or 2.3% increase compared to the same period in 2013. During the year ended

December 31, 2014, we incurred higher depreciation expense from equipment leased primarily to new and existing

subscribers with new Hopper receiver systems, partially offset by a decrease in depreciation expense related to

certain satellites transferred to EchoStar as part of the Satellite and Tracking Stock Transaction. The year ended

December 31, 2013 was negatively impacted by $53 million of additional depreciation expense as a result of the

accelerated depreciable lives of certain assets designed to support the TerreStar MSS business.

Impairment of long-lived assets. “Impairment of long-lived assets” of $438 million during the year ended

December 31, 2013 resulted from an impairment of the T2 and D1 satellites. See Note 8 in the Notes to our

Consolidated Financial Statements in this Annual Report on Form 10-K for further information.

Interest income. “Interest income” totaled $62 million during the year ended December 31, 2014, a decrease of $87

million or 58.5% compared to the same period in 2013. This decrease principally resulted from lower percentage

returns earned on our cash and marketable investment securities during 2014.

Interest expense, net of amounts capitalized. “Interest expense, net of amounts capitalized” totaled $611 million

during the year ended December 31, 2014, a decrease of $134 million or 18.0% compared to the same period in 2013.

This decrease was primarily related to an increase in capitalized interest principally associated with our wireless

spectrum. The decrease was also driven by a reduction in interest expense as a result of redemptions and

repurchases of debt during 2013 and 2014, partially offset by the issuance of debt in November 2014.

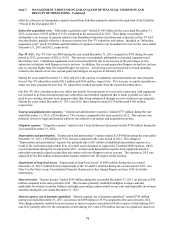

Other, net. “Other, net” expense was $69 million during the year ended December 31, 2014, compared to income of

$385 million for the same period in 2013. The year ended December 31, 2014 was negatively impacted by net realized

and/or unrealized losses on our marketable investment securities and derivative financial instruments. The year ended

December 31, 2013 was positively impacted by net realized and/or unrealized gains on our marketable investment

securities and derivative financial instruments.

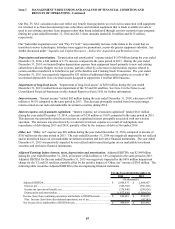

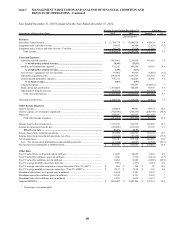

Adjusted Earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA was $2.849 billion

during the year ended December 31, 2014, an increase of $44 million or 1.6% compared to the same period in 2013.

Adjusted EBITDA for the year ended December 31, 2013 was negatively impacted by the $438 million impairment

charge for the T2 and D1 satellites, partially offset by the positive impact of “Other, net” income of $385 million. The

following table reconciles Adjusted EBITDA to the accompanying financial statements.

2014 2013

Adjusted EBITDA................................................................................................... 2,848,837$ 2,804,807$

Interest, net............................................................................................................ (549,368) (596,120)

Income tax (provision) benefit, net........................................................................ (276,840) (299,826)

Depreciation and amortization............................................................................... (1,077,936) (1,054,026)

Income (loss) from continuing operations attributable to DISH Network............... 944,693$ 854,835$

Plus: Income (loss) from discontinued operations, net of tax............................... - (47,343)

Net income (loss) attributable to DISH Network..................................................... 944,693$ 807,492$

For the Years Ended December 31,

(In thousands)