Dish Network 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-36

Capital Lease Obligations

Anik F3. Anik F3, an FSS satellite, was launched and commenced commercial operation during April 2007. This

satellite is accounted for as a capital lease and depreciated over the term of the satellite service agreement. We have

leased 100% of the Ku-band capacity on Anik F3 for a period of 15 years.

Ciel II. Ciel II, a Canadian DBS satellite, was launched in December 2008 and commenced commercial operation

during February 2009. This satellite is accounted for as a capital lease and depreciated over the term of the satellite

service agreement. We have leased 100% of the capacity on Ciel II for an initial 10 year term.

As of December 31, 2014 and 2013, we had $500 million capitalized for the estimated fair value of satellites

acquired under capital leases included in “Property and equipment, net,” with related accumulated depreciation of

$279 million and $236 million, respectively. In our Consolidated Statements of Operations and Comprehensive

Income (Loss), we recognized $43 million, $43 million and $43 million in depreciation expense on satellites

acquired under capital lease agreements during the years ended December 31, 2014, 2013 and 2012, respectively.

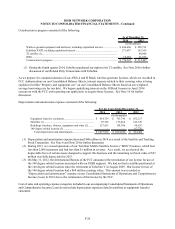

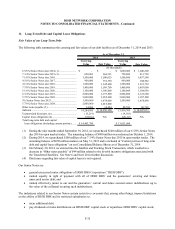

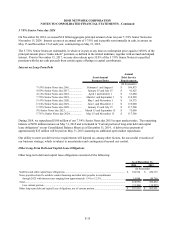

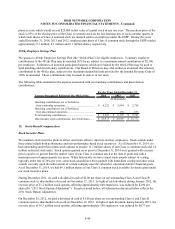

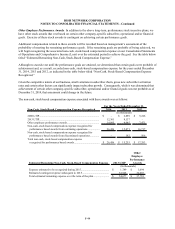

Future minimum lease payments under the capital lease obligations, together with the present value of the net

minimum lease payments as of December 31, 2014 are as follows (in thousands):

For the Years Ended December 31,

2015.............................................................................................................................................................. 77,089$

2016.............................................................................................................................................................. 76,809

2017.............................................................................................................................................................. 76,007

2018.............................................................................................................................................................. 75,982

2019.............................................................................................................................................................. 50,331

Thereafter..................................................................................................................................................... 112,000

Total minimum lease payments.................................................................................................................... 468,218

Less: Amount representing lease of the orbital location and estimated executory costs (primarily

insurance and maintenance) including profit thereon, included in total minimum lease payments............. (220,883)

Net minimum lease payments....................................................................................................................... 247,335

Less: Amount representing interest.............................................................................................................. (52,421)

Present value of net minimum lease payments.............................................................................................. 194,914

Less: Current portion................................................................................................................................... (28,378)

Long-term portion of capital lease obligations............................................................................................. 166,536$

The summary of future maturities of our outstanding long-term debt as of December 31, 2014 is included in the

commitments table in Note 16.

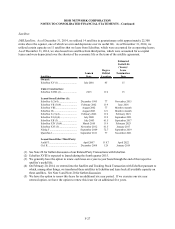

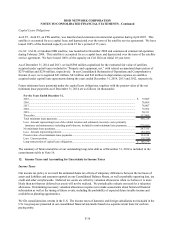

12. Income Taxes and Accounting for Uncertainty in Income Taxes

Income Taxes

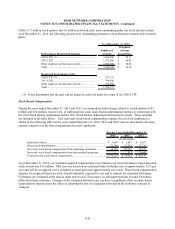

Our income tax policy is to record the estimated future tax effects of temporary differences between the tax bases of

assets and liabilities and amounts reported on our Consolidated Balance Sheets, as well as probable operating loss, tax

credit and other carryforwards. Deferred tax assets are offset by valuation allowances when we believe it is more

likely than not that net deferred tax assets will not be realized. We periodically evaluate our need for a valuation

allowance. Determining necessary valuation allowances requires us to make assessments about historical financial

information as well as the timing of future events, including the probability of expected future taxable income and

available tax planning opportunities.

We file consolidated tax returns in the U.S. The income taxes of domestic and foreign subsidiaries not included in the

U.S. tax group are presented in our consolidated financial statements based on a separate return basis for each tax

paying entity.