Dish Network 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-30

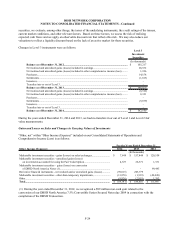

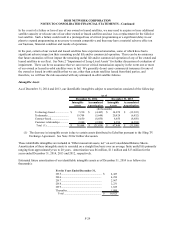

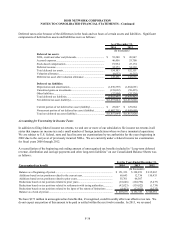

Goodwill

The excess of our investments in consolidated subsidiaries over net tangible and identifiable intangible asset value

at the time of the investment is recorded as goodwill and is not subject to amortization but is subject to impairment

testing annually or whenever indicators of impairment arise. As of December 31, 2014 and 2013, our goodwill was

$120 million and $126 million, respectively, which primarily related to our wireless segment. The decrease in

goodwill is due to certain assets distributed to EchoStar pursuant to the Sling TV Exchange Agreement. See Note

20 for further discussion. In conducting our annual impairment test in 2014, we determined that the fair value of

our wireless segment was in excess of the carrying value.

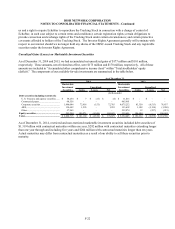

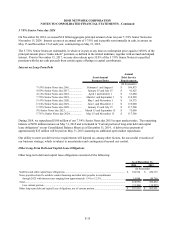

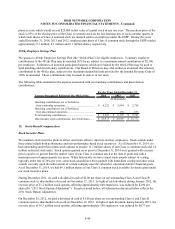

FCC Authorizations

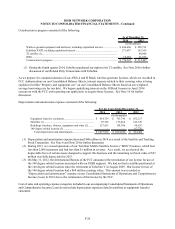

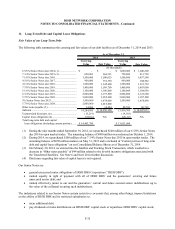

As of December 31, 2014 and 2013, our FCC Authorizations consisted of the following:

2014 2013

DBS Licenses............................................ 611,794$ 611,794$

700 MHz Licenses..................................... 711,871 711,871

MVDDS Licenses (1)................................ 24,000 24,000

AWS-4 Licenses........................................ 1,949,000 1,949,000

H-Block Licenses (2)................................ 1,671,506 -

Total ........................................................ 4,968,171$ 3,296,665$

As of December 31,

(In thousands)

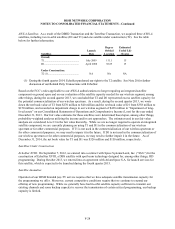

(1) We have multichannel video distribution and data service (“MVDDS”) licenses in 82 out of 214

geographical license areas, including Los Angeles, New York City, Chicago and several other major

metropolitan areas. By August 2014, we were required to meet certain FCC build-out requirements related

to our MVDDS licenses, and we are subject to certain FCC service rules applicable to these licenses. In

January 2015, the FCC granted our application to extend the build-out requirements related to our MVDDS

licenses. We now have until 2019 to provide “substantial service” on our MVDDS licenses, and the

licenses expire in 2024. Our MVDDS licenses may be terminated, however, if we do not provide

substantial service in accordance with the new build-out requirements.

(2) On April 29, 2014, the FCC issued an order granting our application to acquire all 176 wireless spectrum

licenses in the H Block auction. See Note 16 for further discussion.

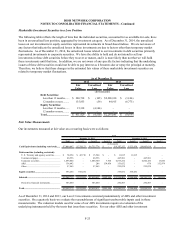

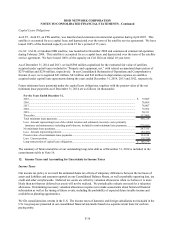

9. Acquisitions

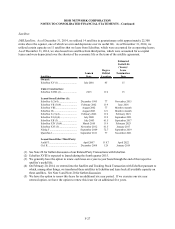

DBSD North America and TerreStar Transactions

On March 2, 2012, the FCC approved the transfer of 40 MHz of wireless spectrum licenses held by DBSD North

America, Inc. (“DBSD North America”) and TerreStar Networks, Inc. (“TerreStar”) to us. On March 9, 2012, we

completed the acquisitions of 100% of the equity of reorganized DBSD North America and substantially all of the

assets of TerreStar, pursuant to which we acquired, among other things, certain satellite assets and 40 MHz of

spectrum licenses held by DBSD North America (the “DBSD Transaction”) and TerreStar (the “TerreStar

Transaction”), which licenses the FCC modified in March 2013 to add AWS-4 authority (“AWS-4”). The total

consideration to acquire the DBSD North America and TerreStar assets was approximately $2.860 billion. See Note

16 for further information.

As a result of these acquisitions, we recognized the acquired assets and assumed liabilities based on our estimates of

fair value at their acquisition date, including $102 million in an uncertain tax position in “Long-term deferred

revenue, distribution and carriage payments and other long-term liabilities” on our Consolidated Balance Sheets.

Subsequently, in the third quarter 2013, this uncertain tax position was resolved and $102 million was reversed and