Dish Network 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

77

77

will be successful in reducing or controlling theft of our programming content and we may incur additional costs in

the future if our system’s security is compromised.

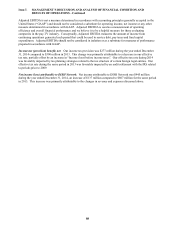

Stock Repurchases

Our Board of Directors previously authorized the repurchase of up to $1.0 billion of our Class A common stock. On

October 30, 2014, our Board of Directors extended this authorization such that we are currently authorized to

repurchase up to $1.0 billion of outstanding shares of our Class A common stock through and including December

31, 2015. As of December 31, 2014, we may repurchase up to $1.0 billion of our Class A common stock under this

plan. During the years ended December 31, 2014, 2013 and 2012, there were no repurchases of our Class A

common stock.

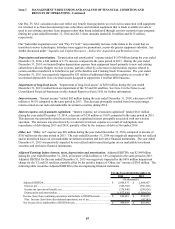

Subscriber Acquisition and Retention Costs

We incur significant upfront costs to acquire subscribers, including advertising, retailer incentives, equipment

subsidies, installation services, and new customer promotions. While we attempt to recoup these upfront costs over

the lives of their subscription, there can be no assurance that we will. We employ business rules such as minimum

credit requirements for prospective customers and we strive to provide outstanding customer service, to increase the

likelihood of customers keeping their DISH service over longer periods of time. Our subscriber acquisition costs

may vary significantly from period to period.

We incur significant costs to retain our existing customers, mostly by upgrading their equipment to HD and DVR

receivers and by providing retention credits. As with our subscriber acquisition costs, our retention upgrade

spending includes the cost of equipment and installation services. In certain circumstances, we also offer

programming at no additional charge and/or promotional pricing for limited periods for existing customers in

exchange for a contractual commitment to receive service for a minimum term. A component of our retention

efforts includes the installation of equipment for customers who move. Our subscriber retention costs may vary

significantly from period to period.

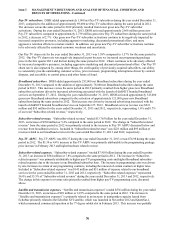

Covenants and Restrictions Related to our Senior Notes

The indentures related to our outstanding senior notes contain restrictive covenants that, among other things, impose

limitations on the ability of DISH DBS and its restricted subsidiaries to: (i) incur additional indebtedness; (ii) enter

into sale and leaseback transactions; (iii) pay dividends or make distributions on DISH DBS’ capital stock or

repurchase DISH DBS’ capital stock; (iv) make certain investments; (v) create liens; (vi) enter into certain

transactions with affiliates; (vii) merge or consolidate with another company; and (viii) transfer or sell assets.

Should we fail to comply with these covenants, all or a portion of the debt under the senior notes could become

immediately payable. The senior notes also provide that the debt may be required to be prepaid if certain change-in-

control events occur. As of the date of filing of this Annual Report on Form 10-K, DISH DBS was in compliance

with the covenants.

Other

We are also vulnerable to fraud, particularly in the acquisition of new subscribers. While we are addressing the

impact of subscriber fraud through a number of actions, there can be no assurance that we will not continue to

experience fraud, which could impact our subscriber growth and churn. Economic weakness may create greater

incentive for signal theft, piracy and subscriber fraud, which could lead to higher subscriber churn and reduced

revenue.