Dish Network 2014 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-45

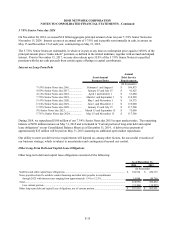

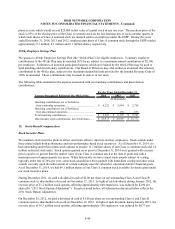

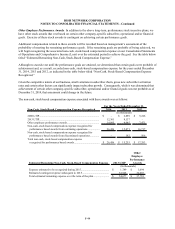

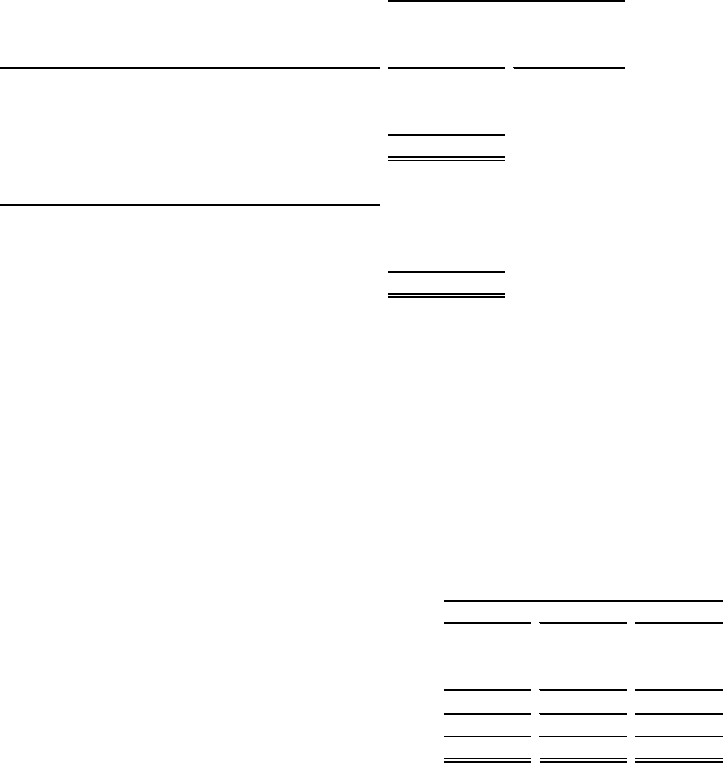

Of the 11.7 million stock options and 1.8 million restricted stock units outstanding under our stock incentive plans

as of December 31, 2014, the following awards were outstanding pursuant to our performance-based stock incentive

plans:

Performance Based Stock Options

Number of

Awards

Weighted-

Average

Grant Price

2005 LTIP (1).......................................................... 3,164,500 20.31$

2013 LTIP................................................................ 1,592,000 40.02$

Other employee performance awards....................... 2,490,000 18.85$

Total......................................................................... 7,246,500 24.14$

Restricted Performance Units

2005 LTIP (1).......................................................... 277,331

2013 LTIP................................................................ 796,000

Other employee performance awards....................... 725,000

Total......................................................................... 1,798,331

As of December 31, 2014

(1) It was determined that the goal can no longer be achieved under the terms of the 2005 LTIP.

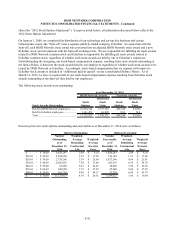

Stock-Based Compensation

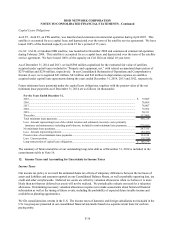

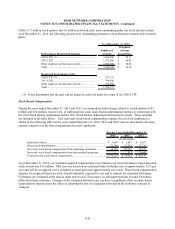

During the years ended December 31, 2013 and 2012, we incurred an initial charge related to vested options of $5

million and $14 million, respectively, of additional non-cash, stock-based compensation expense in connection with

the 2012 Stock Option Adjustment and the 2011 Stock Option Adjustment discussed previously. These amounts

are included in the table below. Total non-cash, stock-based compensation expense for all of our employees is

shown in the following table for the years ended December 31, 2014, 2013 and 2012 and was allocated to the same

expense categories as the base compensation for such employees:

2014 2013 2012

Subscriber-related....................................................................................... 1,859$ 1,947$ 1,607$

General and administrative.......................................................................... 32,294 27,783 37,720

Non-cash, stock-based compensation from continuing operations.............. 34,153 29,730 39,327

Non-cash, stock-based compensation from discontinued operations.......... - 925 1,643

Total non-cash, stock-based compensation ................................................ 34,153$ 30,655$ 40,970$

For the Years Ended December 31,

(In thousands)

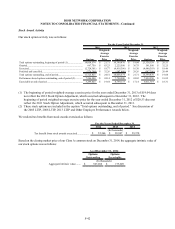

As of December 31, 2014, our total unrecognized compensation cost related to our non-performance based unvested

stock awards was $15 million. This cost was based on an estimated future forfeiture rate of approximately 3.2% per

year and will be recognized over a weighted-average period of approximately two years. Share-based compensation

expense is recognized based on stock awards ultimately expected to vest and is reduced for estimated forfeitures.

Forfeitures are estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures

differ from those estimates. Changes in the estimated forfeiture rate can have a significant effect on share-based

compensation expense since the effect of adjusting the rate is recognized in the period the forfeiture estimate is

changed.