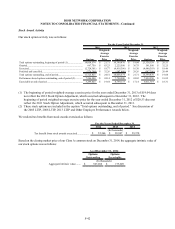

Dish Network 2014 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-32

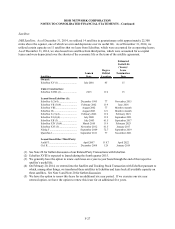

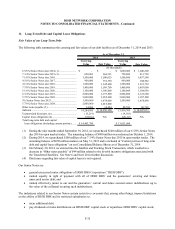

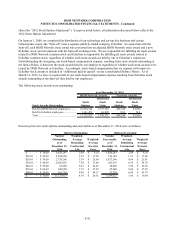

11. Long-Term Debt and Capital Lease Obligations

Fair Value of our Long-Term Debt

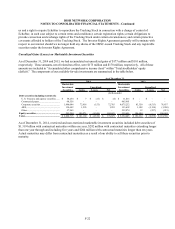

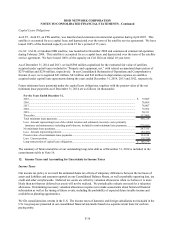

The following table summarizes the carrying and fair values of our debt facilities as of December 31, 2014 and 2013:

Carrying

Value Fair Value

Carrying

Value Fair Value

6 5/8% Senior Notes due 2014 (1).......................... $ - $ - $ 1,000,000 $ 1,040,200

7 3/4% Senior Notes due 2015 (2).......................... 650,001 664,321 750,000 813,750

7 1/8% Senior Notes due 2016................................ 1,500,000 1,580,625 1,500,000 1,657,500

4 5/8% Senior Notes due 2017................................ 900,000 933,750 900,000 946,962

4 1/4% Senior Notes due 2018................................ 1,200,000 1,245,600 1,200,000 1,221,792

7 7/8% Senior Notes due 2019................................ 1,400,000 1,589,700 1,400,000 1,603,000

5 1/8% Senior Notes due 2020................................ 1,100,000 1,100,000 1,100,000 1,104,950

6 3/4% Senior Notes due 2021................................ 2,000,000 2,157,500 2,000,000 2,122,500

5 7/8% Senior Notes due 2022................................ 2,000,000 2,055,000 2,000,000 1,997,500

5% Senior Notes due 2023...................................... 1,500,000 1,470,000 1,500,000 1,458,090

5 7/8% Senior Notes due 2024................................ 2,000,000 2,019,800 - -

Other notes payable (3)............................................ 34,084 34,084 80,769 80,769

Subtotal.................................................................... 14,284,085 14,850,380$ 13,430,769 14,047,013$

Unamortized discounts, net.....................................

(

15,219

)

(

19,198

)

Capital lease obligations (4).................................... 194,914 NA 220,115 NA

Total long-term debt and capital

lease obligations (including current portion)........ 14,463,780$ 13,631,686$

2014 2013

(In thousands)

As of December 31,

(1) During the nine months ended September 30, 2014, we repurchased $100 million of our 6 5/8% Senior Notes

due 2014 in open market trades. The remaining balance of $900 million was redeemed on October 1, 2014.

(2) During 2014, we repurchased $100 million of our 7 3/4% Senior Notes due 2015 in open market trades. The

remaining balance of $650 million matures on May 31, 2015 and is included in “Current portion of long-term

debt and capital lease obligations” on our Consolidated Balance Sheets as of December 31, 2014.

(3) On February 20, 2014, we entered into the Satellite and Tracking Stock Transaction, which resulted in a

decrease in “Other notes payable” of $44 million related to the in-orbit incentive obligations associated with

the Transferred Satellites. See Note 6 and Note 20 for further discussion.

(4) Disclosure regarding fair value of capital leases is not required.

Our Senior Notes are:

general unsecured senior obligations of DISH DBS Corporation (“DISH DBS”);

ranked equally in right of payment with all of DISH DBS’ and the guarantors’ existing and future

unsecured senior debt; and

ranked effectively junior to our and the guarantors’ current and future secured senior indebtedness up to

the value of the collateral securing such indebtedness.

The indentures related to our Senior Notes contain restrictive covenants that, among other things, impose limitations

on the ability of DISH DBS and its restricted subsidiaries to:

incur additional debt;

pay dividends or make distributions on DISH DBS’ capital stock or repurchase DISH DBS’ capital stock;