Dish Network 2014 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-38

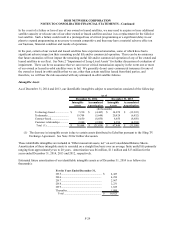

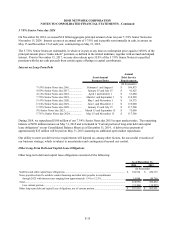

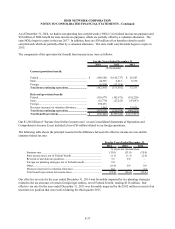

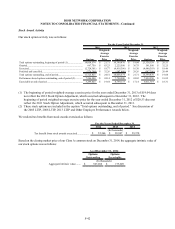

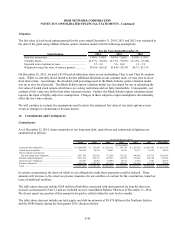

Deferred taxes arise because of the differences in the book and tax bases of certain assets and liabilities. Significant

components of deferred tax assets and liabilities were as follows:

2014 2013

Deferred tax assets:

NOL, credit and other carryforwards.......................................... 55,280$ 20,947$

Accrued expenses........................................................................ 46,456 53,700

Stock-based compensation.......................................................... 19,994 23,174

Deferred revenue......................................................................... 32,373 54,330

Total deferred tax assets.............................................................. 154,103 152,151

Valuation allowance.................................................................... (8,652) (9,515)

Deferred tax asset after valuation allowance............................... 145,451 142,636

Deferred tax liabilities:

Depreciation and amortization.................................................... (1,830,559) (1,864,691)

Unrealized gains on investments................................................. (139,032) (58,435)

Other liabilities............................................................................ (32,904) (35,336)

Total deferred tax liabilities........................................................ (2,002,495) (1,958,462)

Net deferred tax asset (liability).................................................. (1,857,044)$ (1,815,826)$

Current portion of net deferred tax asset (liability)..................... 25,667$ 129,864$

Noncurrent portion of net deferred tax asset (liability)............... (1,882,711) (1,945,690)

Total net deferred tax asset (liability).......................................... (1,857,044)$ (1,815,826)$

As of December 31,

(In thousands)

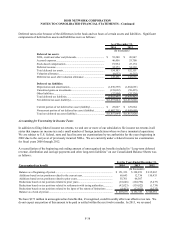

Accounting for Uncertainty in Income Taxes

In addition to filing federal income tax returns, we and one or more of our subsidiaries file income tax returns in all

states that impose an income tax and a small number of foreign jurisdictions where we have immaterial operations.

We are subject to U.S. federal, state and local income tax examinations by tax authorities for the years beginning in

2002 due to the carryover of previously incurred NOLs. We are currently under a federal income tax examination

for fiscal years 2008 through 2012.

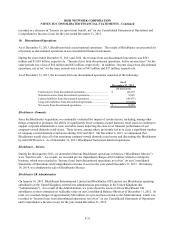

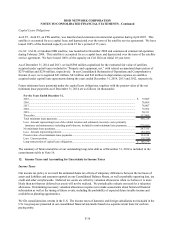

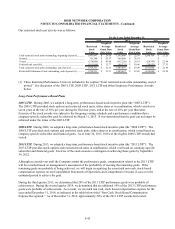

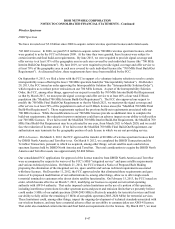

A reconciliation of the beginning and ending amount of unrecognized tax benefits included in “Long-term deferred

revenue, distribution and carriage payments and other long-term liabilities” on our Consolidated Balance Sheets was

as follows:

Unrecognized tax benefit 2014 2013 2012

Balance as of beginning of period..................................................................................... $ 151,353 $ 328,951 $ 235,067

Additions based on tax positions related to the current year.............................................. 69,643 12,736 110,435

Additions based on tax positions related to prior years..................................................... 55,761 66,307 -

Reductions based on tax positions related to prior years................................................... (18,646) (104,796) (5,477)

Reductions based on tax positions related to settlements with taxing authorities.............. (42,023) (139,022) (1,739)

Reductions based on tax positions related to the lapse of the statute of limitations .......... (8,413) (12,823) (9,335)

Balance as of end of period............................................................................................... 207,675$ 151,353$ 328,951$

For the Years Ended December 31,

(In thousands)

We have $173 million in unrecognized tax benefits that, if recognized, could favorably affect our effective tax rate. We

do not expect any portion of this amount to be paid or settled within the next twelve months. In 2013, we reversed