Dish Network 2014 Annual Report Download - page 120

Download and view the complete annual report

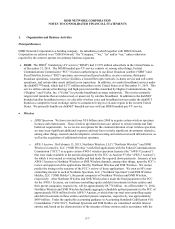

Please find page 120 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-14

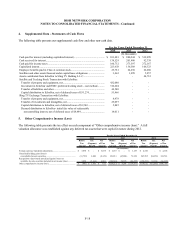

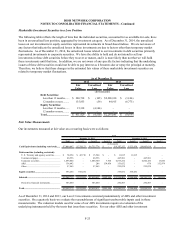

Fair Value Measurements

We determine fair value based on the exchange price that would be received for an asset or paid to transfer a

liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly

transaction between market participants. Market or observable inputs are the preferred source of values, followed

by unobservable inputs or assumptions based on hypothetical transactions in the absence of market inputs. We

apply the following hierarchy in determining fair value:

Level 1, defined as observable inputs being quoted prices in active markets for identical assets;

Level 2, defined as observable inputs other than quoted prices included in Level 1, including quoted prices

for similar assets and liabilities in active markets; quoted prices for identical or similar instruments in

markets that are not active; and derivative financial instruments indexed to marketable investment

securities; and

Level 3, defined as unobservable inputs for which little or no market data exists, consistent with reasonably

available assumptions made by other participants therefore requiring assumptions based on the best

information available.

As of December 31, 2014 and 2013, the carrying value for cash and cash equivalents, trade accounts receivable (net

of allowance for doubtful accounts) and current liabilities (excluding the “Current portion of long-term debt and

capital lease obligations”) is equal to or approximates fair value due to their short-term nature or proximity to

current market rates. See Note 6 for the fair value of our marketable investment securities and derivative financial

instruments.

Fair values for our publicly traded debt securities are based on quoted market prices, when available. The fair

values of private debt are estimated based on an analysis in which we evaluate market conditions, related securities,

various public and private offerings, and other publicly available information. In performing this analysis, we make

various assumptions regarding, among other things, credit spreads, and the impact of these factors on the value of

the debt securities. See Note 11 for the fair value of our long-term debt.

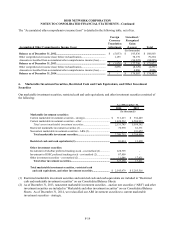

Deferred Debt Issuance Costs

Costs of issuing debt are generally deferred and amortized to interest expense using the effective interest rate method

over the terms of the respective notes. See Note 11.

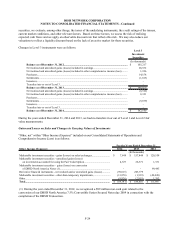

Revenue Recognition

We recognize revenue when an arrangement exists, prices are determinable, collectability is reasonably assured and

the goods or services have been delivered.

Revenue from our pay-TV service is recognized when programming is broadcast to subscribers. We recognize

revenue from our broadband services when the service is provided. Payments received from Pay-TV and

Broadband subscribers in advance of the broadcast or service period are recorded as “Deferred revenue and other”

in our Consolidated Balance Sheets until earned.

For certain of our promotions, subscribers are charged an upfront fee. A portion of these fees may be deferred and

recognized over the estimated subscriber life for new subscribers or the estimated remaining life for existing subscribers

ranging from four to five years. Revenue from advertising sales is recognized when the related services are

performed.