Dish Network 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

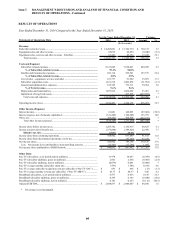

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

74

74

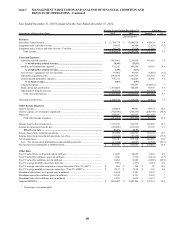

Adjusted Free Cash Flow

We define adjusted free cash flow as “Net cash flows from operating activities from continuing operations” less

“Purchases of property and equipment,” as shown on our Consolidated Statements of Cash Flows. We believe

adjusted free cash flow is an important liquidity metric because it measures, during a given period, the amount of

cash generated that is available to repay debt obligations, make investments, fund acquisitions and for certain other

activities. Adjusted free cash flow is not a measure determined in accordance with GAAP and should not be

considered a substitute for “Operating income,” “Net income,” “Net cash flows from operating activities” or any

other measure determined in accordance with GAAP. Since adjusted free cash flow includes investments in

operating assets, we believe this non-GAAP liquidity measure is useful in addition to the most directly comparable

GAAP measure “Net cash flows from operating activities from continuing operations.”

During the years ended December 31, 2014, 2013 and 2012, adjusted free cash flow was significantly impacted by

changes in operating assets and liabilities and in “Purchases of property and equipment” as shown in the “Net cash

flows from operating activities from continuing operations” and “Net cash flows from investing activities from

continuing operations” sections, respectively, of our Consolidated Statements of Cash Flows included herein.

Operating asset and liability balances can fluctuate significantly from period to period and there can be no assurance

that adjusted free cash flow will not be negatively impacted by material changes in operating assets and liabilities in

future periods, since these changes depend upon, among other things, management’s timing of payments and control of

inventory levels, and cash receipts. In addition to fluctuations resulting from changes in operating assets and liabilities,

adjusted free cash flow can vary significantly from period to period depending upon, among other things, subscriber

growth, subscriber revenue, subscriber churn, subscriber acquisition and retention costs including amounts capitalized

under our equipment lease programs, operating efficiencies, increases or decreases in purchases of property and

equipment, and other factors.

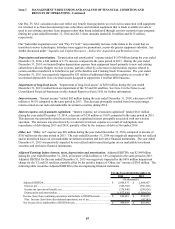

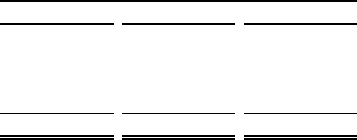

The following table reconciles adjusted free cash flow to “Net cash flows from operating activities from continuing

operations.”

2014 2013 2012

Adjusted free cash flow.................................................................................. 1,192,270$ 1,055,698$ 1,058,384$

Add back:

Purchase of property and equipment........................................................... 1,215,861 1,253,499 945,334

Net cash flows from operating activities from continuing operations............. 2,408,131$ 2,309,197$ 2,003,718$

For the Years Ended December 31,

(In thousands)

The increase in adjusted free cash flow from 2013 to 2014 of $137 million primarily resulted from an increase in

“Net cash flows from operating activities from continuing operations” of $99 million and from a decrease in

“Purchases of property and equipment” of $38 million. The decrease in “Purchases of property and equipment” in

2014 was primarily attributable to a decrease in expenditures for equipment under our lease programs for new and

existing Pay-TV and Broadband subscribers, partially offset by an increase in satellite construction and other

corporate capital expenditures. The increase in “Net cash flows from operating activities from continuing

operations” was primarily attributable to a $135 million increase in income from continuing operations adjusted to

exclude non-cash charges for “Deferred tax expense (benefit),” “Impairment of long-lived assets,” “Realized and

unrealized losses (gains) on investments” and “Depreciation and amortization” expense. This increase was partially

offset by a decrease in cash resulting from changes in operating assets and liabilities principally attributable to

timing differences between book expense and cash payments.

The decrease in adjusted free cash flow from 2012 to 2013 of $3 million primarily resulted from an increase in

“Purchases of property and equipment” of $308 million, partially offset by an increase in “Net cash flows from

operating activities from continuing operations” of $305 million. The increase in “Purchases of property and

equipment” in 2013 was primarily attributable to an increase in expenditures for equipment under our lease

programs for new and existing Pay-TV and Broadband subscribers and an increase in satellite construction and other

corporate capital expenditures. The increase in “Net cash flows from operating activities from continuing

operations” was primarily attributable to a $243 million increase of income from continuing operations adjusted to

exclude non-cash charges for “Impairment of long-lived assets,” “Depreciation and amortization” expense,