Dish Network 2014 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2014 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-50

Holdco will be approximately $524 million and the total loans from American III to SNR Wireless will be

approximately $3.503 billion.

After Northstar Wireless and SNR Wireless have made the final payments to the FCC for the Northstar Licenses

and the SNR Licenses, respectively, our total non-controlling equity and debt investments in the Northstar Entities

and the SNR Entities will be approximately $9.778 billion. We have funded and will fund these investments from

existing cash and marketable investment securities. Such funding has included and will include $899 million in

total equity and debt investments in the Northstar Entities and SNR Entities during the fourth quarter 2014, cash and

marketable investment securities as of December 31, 2014, cash generated from operations during 2015, and a $400

million refund from the FCC to one of our wholly-owned subsidiaries related to the AWS-3 Auction. Issuance of

any AWS-3 Licenses to Northstar Wireless and SNR Wireless depends, among other things, upon the FCC’s review

and approval of the applications filed by Northstar Wireless and SNR Wireless. Objections to the applications filed

by Northstar Wireless and SNR Wireless must be submitted to the FCC within ten calendar days following the

release by the FCC of the public notice listing the applications acceptable for filing. We cannot predict the timing

or the outcome of the FCC’s review of the applications filed by Northstar Wireless and SNR Wireless.

In the event that the FCC grants the Northstar Licenses and the SNR Licenses, we may need to make significant

additional loans to the Northstar Entities and the SNR Entities, or they may need to partner with others, so that the

Northstar Entities and the SNR Entities may commercialize, build-out and integrate the Northstar Licenses and the

SNR Licenses, and comply with regulations applicable to the Northstar Licenses and the SNR Licenses. Depending

upon the nature and scope of such commercialization, build-out, integration efforts, and regulatory compliance, any

such loans or partnerships could vary significantly. There can be no assurance that we will be able to obtain a

profitable return on our non-controlling investments in the Northstar Entities and the SNR Entities.

Guarantees

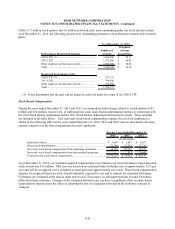

During the third quarter 2009, EchoStar entered into a new satellite transponder service agreement for Nimiq 5 through

2024. We sublease this capacity from EchoStar and also guarantee a certain portion of EchoStar’s obligation under its

satellite transponder service agreement through 2019. As of December 31, 2014, the remaining obligation of our

guarantee was $312 million.

As of December 31, 2014, we have not recorded a liability on the balance sheet for this guarantee.

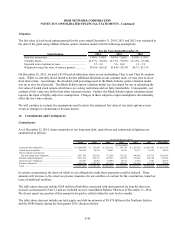

Purchase Obligations

Our 2015 purchase obligations primarily consist of binding purchase orders for receiver systems and related

equipment, broadband equipment, digital broadcast operations, engineering services, and products and services

related to the operation of our DISH branded pay-TV service. Our purchase obligations also include certain fixed

contractual commitments to purchase programming content. Our purchase obligations can fluctuate significantly

from period to period due to, among other things, management’s control of inventory levels, and can materially

impact our future operating asset and liability balances, and our future working capital requirements.

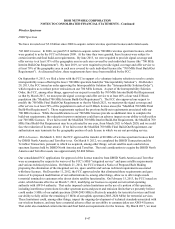

Programming Contracts

In the normal course of business, we enter into contracts to purchase programming content in which our payment

obligations are generally contingent on the number of Pay-TV subscribers to whom we provide the respective

content. These programming commitments are not included in the “Commitments” table above. The terms of our

contracts typically range from one to ten years with annual rate increases. Our programming expenses will continue

to increase to the extent we are successful in growing our Pay-TV subscriber base. In addition, our margins may face

further downward pressure from price increases and the renewal of long-term pay-TV programming contracts on

less favorable pricing terms.