Dish Network 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–10

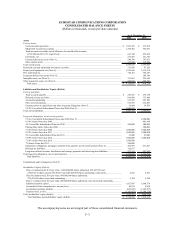

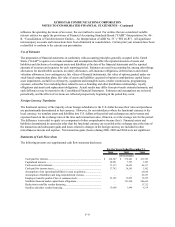

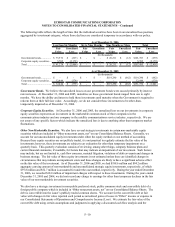

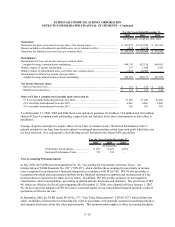

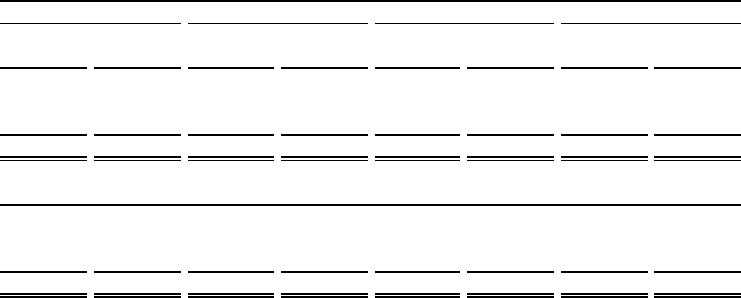

The following table reflects the length of time that the individual securities have been in an unrealized loss position,

aggregated by investment category, where those declines are considered temporary in accordance with our policy.

As of December 31, 2006

Less than Six Months Six to Nine Months Nine Months or More

Fair Unrealized Fair Unrealized Fair Unrealized Fair Unrealized

Value Loss Value Loss Value Loss Value Loss

(In thousands)

Government bonds................ 75,572$ (227)$ -$ -$ 26,211$ (12)$ 101,783$ (239)$

Corporate equity securities.... 5,702 (2,179) - - - - 5,702 (2,179)

Total ..................................... 81,274$ (2,406)$ -$ -$ 26,211$ (12)$ 107,485$ (2,418)$

As of December 31, 2005

(In thousands)

Government bonds................ -$ -$ -$ -$ 119,290$ (662)$ 119,290$ (662)$

Corporate equity securities.... 32,444 (379) - - - - 32,444 (379)

Total ..................................... 32,444$ (379)$ -$ -$ 119,290$ (662)$ 151,734$ (1,041)$

Total

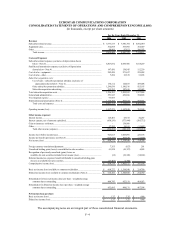

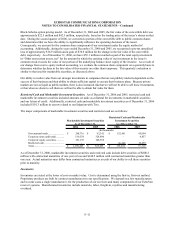

Government Bonds. We believe the unrealized losses on our government bonds were caused primarily by interest

rate increases. At December 31, 2006 and 2005, maturities on these government bonds ranged from one to eight

months. We have the ability and intent to hold these investments until maturity when the Government is required to

redeem them at their full face value. Accordingly, we do not consider these investments to be other-than-

temporarily impaired as of December 31, 2006.

Corporate Equity Securities. At December 31, 2006 and 2005, the unrealized loss on our investments in corporate

equity securities represents an investment in the marketable common stock of three companies in the

communications industry and one company in the satellite communications service industry, respectively. We are

not aware of any specific factors which indicate the unrealized loss is due to anything other than temporary market

fluctuations.

Other Non-Marketable Securities. We also have several strategic investments in certain non-marketable equity

securities which are included in “Other noncurrent assets, net” on our Consolidated Balance Sheets. Generally, we

account for our unconsolidated equity investments under either the equity method or cost method of accounting.

Because these equity securities are not publicly traded, it is not practical to regularly estimate the fair value of the

investments; however, these investments are subject to an evaluation for other than temporary impairment on a

quarterly basis. This quarterly evaluation consists of reviewing, among other things, company business plans and

current financial statements, if available, for factors that may indicate an impairment of our investment. Such factors

may include, but are not limited to, cash flow concerns, material litigation, violations of debt covenants and changes in

business strategy. The fair value of these equity investments is not estimated unless there are identified changes in

circumstances that may indicate an impairment exists and these changes are likely to have a significant adverse effect

on the fair value of the investment. As of December 31, 2006 and 2005, we had $188.6 million and $94.2 million

aggregate carrying amount of non-marketable and unconsolidated strategic equity investments, respectively, of which

$97.8 million and $52.7 million is accounted for under the cost method, respectively. During the year ended December

31, 2006, we recorded $18.0 million of impairment charges with respect to these investments. During the years ended

December 31, 2005 and 2004, we did not record any charge to earnings for other than temporary declines in the fair

value of our non-marketable investment securities.

We also have a strategic investment in non-public preferred stock, public common stock and convertible debt of a

foreign public company which is included in “Other noncurrent assets, net” on our Consolidated Balance Sheets. The

debt is convertible into the issuer’s publicly traded common shares. We account for the convertible debt at fair

value with changes in fair value reported each period as unrealized gains or losses in “Other” income or expense in

our Consolidated Statements of Operations and Comprehensive Income (Loss). We estimate the fair value of the

convertible debt using certain assumptions and judgments in applying a discounted cash flow analysis and the