Dish Network 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

58

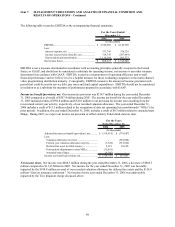

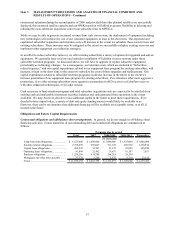

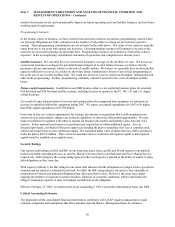

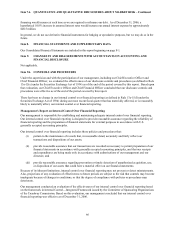

Interest on Long-Term Debt

We have semi-annual cash interest requirements for our outstanding long-term debt securities (see Note 5 in the Notes

to the Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K for details), as follows:

Annual

Quarterly/Semi-Annual Debt Service

Payment Dates Requirements*

3 % Convertible Subordinated Notes due 2010 ................ June 30 and December 31 15,000,000$

5 3/4% Senior Notes due 2008 .......................................... April 1 and October 1 57,500,000$

6 3/8% Senior Notes due 2011........................................... April 1 and October 1 63,750,000$

3 % Convertible Subordinated Notes due 2011................. June 30 and December 31 750,000$

6 5/8% Senior Notes due 2014........................................... April 1 and October 1 66,250,000$

7 1/8% Senior Notes due 2016........................................... February 1 and August 1 106,875,000$

7% Senior Notes due 2013................................................. April 1 and October 1 35,000,000$

* The table above does not include interest of $14.4 million on the 5 3/4% Convertible Subordinated Notes due

2008 which were redeemed on February 15, 2007 (see Note 14 in the Notes to the Consolidated Financial

Statements in Item 15 of this Annual Report on Form 10-K).

Semi-annual cash interest payments related to our 7% Senior Notes due 2013 will commence on April 1, 2007.

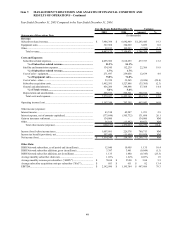

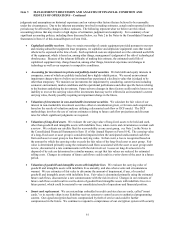

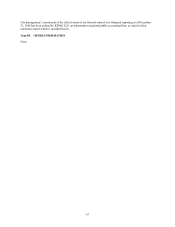

We also have periodic cash interest requirements for our outstanding capital lease obligations, mortgages and other

notes payable. Future cash interest requirements for all of our outstanding long-term debt are summarized as

follows:

Payments due by period

Total 2007 2008-2009 2010-2011 Thereafter

(In thousands)

Long-term debt (1).................................... 2,279,735$ 343,608$ 632,895$ 553,408$ 749,824$

Capital lease obligations, mortgages

and other notes payable ......................... 177,196 36,321 62,388 46,093 32,394

Total ......................................................... 2,456,931$ 379,929$ 695,283$ 599,501$ 782,218$

(1) This does not include interest of $14.4 million on the 5 3/4% Convertible Subordinated Notes due 2008 which

were redeemed on February 15, 2007 (see Note 14 in the Notes to the Consolidated Financial Statements in

Item 15 of this Annual Report on Form 10-K).

Satellite-Related Obligations

Satellites under Construction. We have entered into contracts to construct new satellites which are contractually

scheduled to be completed within the next three years, see “Item 1 – Business – Our Satellites.” Future

commitments related to these satellites are included in the table above under “Satellite-related obligations” except

where noted below.

• During 2004, we entered into a contract for the construction of EchoStar XI which is expected to be

completed in 2007. However, the launch could be delayed until the second half of 2008 as a result of

problems currently being experienced by the launch provider, Sea Launch.

• During 2004 and 2005, we entered into contracts for the construction of four additional SSL Ka and/or Ku

expanded band satellites which are expected to be completed during 2008 and 2009.

• CMBStar, an S-band satellite, is scheduled to be completed during the second quarter of 2008. Provided

required regulatory approvals are obtained and contractual conditions are satisfied, the transponder capacity

of that satellite will be leased to an affiliate of a Chinese regulatory entity.