Dish Network 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

45

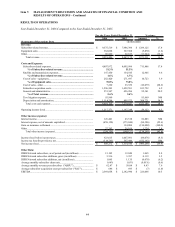

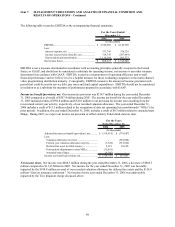

DISH Network subscribers. As of December 31, 2006, we had approximately 13.105 million DISH Network

subscribers compared to approximately 12.040 million subscribers at December 31, 2005, an increase of 8.8%. DISH

Network added approximately 3.516 million gross new subscribers for the year ended December 31, 2006, compared to

approximately 3.397 million gross new subscribers during 2005, an increase of approximately 119,000. The increase

in gross new subscribers resulted in large part from increased advertising and the effectiveness of our promotions and

products during the year. A substantial majority of our gross new subscribers are acquired through our equipment lease

program.

DISH Network added approximately 1.065 million net new subscribers for the year ended December 31, 2006,

compared to approximately 1.135 million net new subscribers during 2005, a decrease of 6.2%. This decrease was

primarily a result of subscriber churn on a larger subscriber base. As the size of our subscriber base increases, even if

our subscriber churn rate remains constant or declines, increasing numbers of gross new DISH Network subscribers

are required to sustain net subscriber growth.

Our gross new subscribers, our net new subscriber additions, and our entire subscriber base are negatively impacted

when existing and new competitors offer more attractive alternatives, including, among other things, video services

bundled with broadband and other telecommunications services, better priced or more attractive programming

packages or more compelling consumer electronic products and services, including DVRs, VOD services, receivers

with multiple tuners, HD programming, or HD and standard definition local channels. We also expect to face

increasing competition from content and other providers who distribute video services directly to consumers over

the Internet. In addition, we will be unable to continue to grow our subscriber base at current rates if we cannot

control our customer churn.

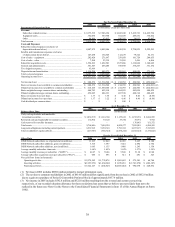

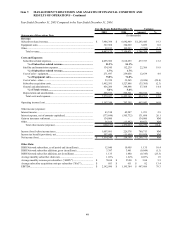

Subscriber-related revenue. DISH Network “Subscriber-related revenue” totaled $9.376 billion for the year ended

December 31, 2006, an increase of $1.389 billion or 17.4% compared to 2005. This increase was directly

attributable to continued DISH Network subscriber growth and the increase in “ARPU” discussed below.

ARPU. Monthly average revenue per subscriber was $62.47 during the year ended December 31, 2006 versus $58.04

during the same period in 2005. The $4.43 or 7.6% increase in ARPU was primarily attributable to price increases in

February 2006 and 2005 on some of our most popular packages, higher equipment rental fees resulting from

increased penetration of our equipment leasing programs, fees for DVRs, revenue from increased availability of

standard and HD local channels by satellite, fees earned from our DishHOME Protection Plan, and HD programming.

This increase was partially offset by a decrease in revenues from installation and other services related to our original

agreement with AT&T.

Equipment sales. For the year ended December 31, 2006, “Equipment sales” totaled $362.1 million, a decrease of

$5.9 million or 1.6% compared to 2005. This decrease principally resulted from a decline in domestic sales of DBS

accessories, partially offset by an increase in sales of non-DISH Network digital receivers and related components to

international customers.

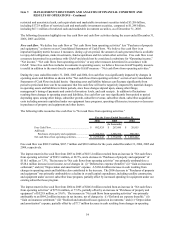

While we currently have certain binding purchase orders from Bell ExpressVu and others through mid-year 2007, we

anticipate that 2007 sales could decline compared to 2006. In addition, the availability of new compression technology

could impact our relationship with Bell ExpressVu depending on its strategy to upgrade customers. There can be no

assurance that Bell ExpressVu will continue to use our equipment in the future.

Subscriber-related expenses. “Subscriber-related expenses” totaled $4.808 billion during the year ended December

31, 2006, an increase of $711.9 million or 17.4% compared to 2005. The increase in “Subscriber-related expenses”

was primarily attributable to the increase in the number of DISH Network subscribers together with an increase in

refurbishment and repair costs for returned EchoStar receiver systems, partially offset by the decline in costs associated

with installation and other services related to our original agreement with AT&T. “Subscriber-related expenses”

represented 51.3% of “Subscriber-related revenue” for each of the years ended December 31, 2006 and 2005.

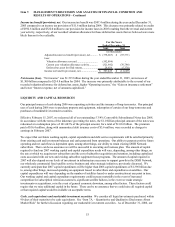

In the normal course of business, we enter into various contracts with programmers to provide content. Our

programming contracts generally require us to make payments based on the number of subscribers to which the

respective content is provided. Consequently, our programming expenses will continue to increase to the extent we are

successful in growing our subscriber base. In addition, because programmers continue to raise the price of content, our