Dish Network 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

53

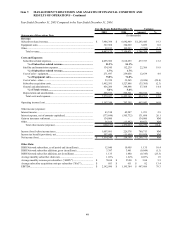

Income tax benefit (provision), net. Our income tax benefit was $507.4 million during the year ended December 31,

2005 compared to an income tax provision of $11.6 million during 2004. This decrease was primarily related to credits

of $592.8 million and $322.0 million to our provision for income taxes in 2005 resulting from the reversal and current

year activity, respectively, of our recorded valuation allowance for those deferred tax assets that we believed were more

likely than not to be realizable.

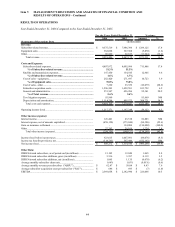

For the Years

Ended December 31,

2005 2004

(In thousands)

Adjusted income tax benefit (provision), net........... (378,687)$ (93,771)$

Less:

Valuation allowance reversal................................ (592,804) -

Current year valuation allowance activity............. (321,982) (76,786)

Deferred tax asset for filed returns........................ 28,650 (5,376)

Income tax benefit (provision), net.......................... 507,449$ (11,609)$

Net income (loss). “Net income” was $1.515 billion during the year ended December 31, 2005, an increase of

$1.300 billion compared to $214.8 million for 2004. The increase was primarily attributable to the reversal of our

recorded valuation allowance for deferred tax assets, higher “Operating income,” the “Gain on insurance settlement”

and lower “Interest expense, net of amounts capitalized.”

LIQUIDITY AND CAPITAL RESOURCES

Our principal sources of cash during 2006 were operating activities and the issuance of long-term notes. Our principal

uses of cash during 2006 were to purchase property and equipment, redemption of certain of our long-term notes and

purchases of marketable investment securities.

Effective February 15, 2007, we redeemed all of our outstanding 5 3/4% Convertible Subordinated Notes due 2008.

In accordance with the terms of the indenture governing the notes, the $1.0 billion principal amount of the notes was

redeemed at a redemption price of 101.643% of the principal amount, for a total of $1.016 billion. The premium

paid of $16.4 million, along with unamortized debt issuance costs of $3.6 million, were recorded as charges to

earnings in February 2007.

We expect that our future working capital, capital expenditure and debt service requirements will be satisfied primarily

from existing cash and investment balances and cash generated from operations. Our ability to generate positive future

operating and net cash flows is dependent upon, among other things, our ability to retain existing DISH Network

subscribers. There can be no assurance we will be successful in executing our business plan. The amount of capital

required to fund our 2007 working capital and capital expenditure needs will vary, depending, among other things, on

the rate at which we acquire new subscribers and the cost of subscriber acquisition and retention, including capitalized

costs associated with our new and existing subscriber equipment lease programs. The amount of capital required in

2007 will also depend on our levels of investment in infrastructure necessary to support growth in the DISH Network,

our wholesale commercial fixed satellite service business and other strategic initiatives, previously discussed. We

currently anticipate that 2007 capital expenditures will be higher than 2006 capital expenditures of $1.396 billion due

to, among other things, increased spending on equipment leased to subscribers and expenditures on satellites. Our

capital expenditures will vary depending on the number of satellites leased or under construction at any point in time.

Our working capital and capital expenditure requirements could increase materially in the event of increased

competition for subscription television customers, significant satellite failures, in the event we make strategic

investments or acquisitions, or in the event of general economic downturn, among other factors. These factors could

require that we raise additional capital in the future. There can be no assurance that we could raise all required capital

or that required capital would be available on acceptable terms.

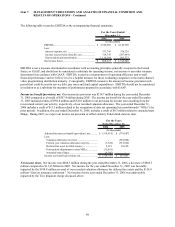

Cash, cash equivalents and marketable investment securities. We consider all liquid investments purchased within

90 days of their maturity to be cash equivalents. See “Item 7A. – Quantitative and Qualitative Disclosures About

Market Risk” for further discussion regarding our marketable investment securities. As of December 31, 2006, our