Dish Network 2006 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–33

Income (Loss), we recognized $55.2 million and $53.3 million in depreciation expense on satellites acquired under

capital lease agreements during the years ended December 31, 2006 and 2005, respectively. During 2004, we did

not recognize any depreciation on the satellites acquired under these capital leases.

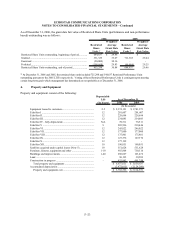

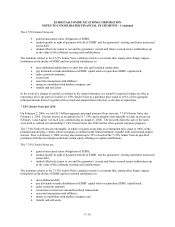

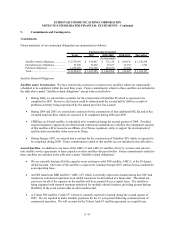

Future minimum lease payments under these capital lease obligations, together with the present value of the net

minimum lease payments as of December 31, 2006 are as follows:

For the Year Ending December 31,

2007.................................................................................................................................................................... 86,351$

2008.................................................................................................................................................................... 86,351

2009.................................................................................................................................................................... 86,351

2010.................................................................................................................................................................... 86,351

2011.................................................................................................................................................................... 86,351

Thereafter........................................................................................................................................................... 254,374

Total minimum lease payments.......................................................................................................................... 686,129

Less: Amount representing lease of the orbital location and estimated executory costs (primarily

insurance and maintenance) including profit thereon, included in total minimum lease payments................... (120,660)

Net minimum lease payments............................................................................................................................. 565,469

Less: Amount representing interest.................................................................................................................... (160,527)

Present value of net minimum lease payments.................................................................................................... 404,942

Less: Current portion......................................................................................................................................... (34,701)

Long-term portion of capital lease obligations................................................................................................... 370,241$

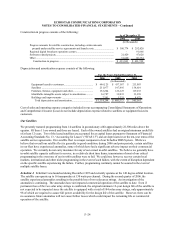

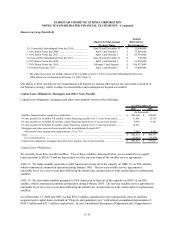

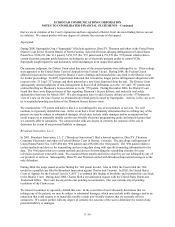

Future maturities of our outstanding long-term debt, including the current portion, are summarized as follows:

Payments due by period

Total 2007 2008-2009 2010-2011 Thereafter

(In thousands)

Long-term debt obligations.................................. 6,525,000$ 1,000,000$ 1,000,000$ 1,525,000$ 3,000,000$

Capital lease obligations, mortgages

and other notes payable .................................. 442,321 38,469 87,053 105,593 211,206

Total .................................................................... 6,967,321$ 1,038,469$ 1,087,053$ 1,630,593$ 3,211,206$

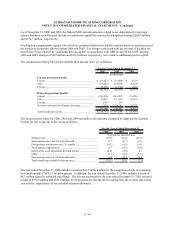

6. Income Taxes

As of December 31, 2006, we had net operating loss carryforwards (“NOL’s”) for federal income tax purposes of

$1.641 billion and tax benefits related to credit carryforwards of $41.9 million. We have recorded in 2006, tax benefits

for state NOL carryforwards of $26.3 million. The NOL’s begin to expire in the year 2020 and credit carryforwards

will begin to expire in the year 2010.

Our income tax policy is to record the estimated future tax effects of temporary differences between the tax bases of

assets and liabilities and amounts reported in our Consolidated Balance Sheets, as well as probable operating loss, tax

credit and other carryforwards. We follow the guidelines set forth in SFAS 109 regarding the recoverability of any tax

assets recorded on the balance sheet and provide any necessary valuation allowances as required. In accordance with

SFAS 109, we periodically evaluate our need for a valuation allowance. Determining necessary valuation allowances

requires us to make assessments about historical financial information as well as the timing of future events, including

the probability of expected future taxable income and available tax planning opportunities. During the second quarter

of 2005, we concluded the recoverability of certain of our deferred tax assets was more likely than not and accordingly

reversed the portion of the valuation allowance which was no longer required. As of December 31, 2006, there remains

$4.0 million of valuation allowance which relates to deferred tax assets for credit carryforwards and state income tax

net operating losses which begin to expire in the year 2010.