Dish Network 2006 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–42

has not been set. We cannot predict with any degree of certainty the outcome of the suit or determine the extent of any

potential liability or damages.

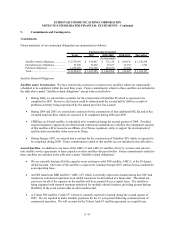

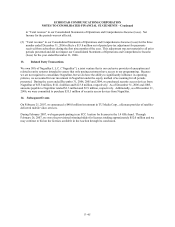

Enron Commercial Paper Investment

During October 2001, we received approximately $40.0 million from the sale of Enron commercial paper to a third

party broker. That commercial paper was ultimately purchased by Enron. During November 2003, an action was

commenced in the United States Bankruptcy Court for the Southern District of New York, against approximately

100 defendants, including us, who invested in Enron’s commercial paper. The complaint alleges that Enron’s

October 2001 purchase of its commercial paper was a fraudulent conveyance and voidable preference under

bankruptcy laws. We dispute these allegations. We typically invest in commercial paper and notes which are rated

in one of the four highest rating categories by at least two nationally recognized statistical rating organizations. At

the time of our investment in Enron commercial paper, it was considered to be high quality and low risk. We cannot

predict with any degree of certainty the outcome of the suit or determine the extent of any potential liability or

damages.

Riyad Alshuaibi

During 2002, Riyad Alshuaibi filed suit against Michael Kelly, one of our executive officers, Kelly Broadcasting

Systems, Inc. (“KBS”), and EchoStar in the District Court of New Jersey. Plaintiff alleged breach of contract,

breach of fiduciary duty, fraud, negligence, and unjust enrichment resulting in damages in excess of $50.0 million.

We denied the allegations of plaintiff's complaint. On October 26, 2006, we reached a settlement which did not

have a material impact on our results of operations.

Other

In addition to the above actions, we are subject to various other legal proceedings and claims which arise in the

ordinary course of business. In our opinion, the amount of ultimate liability with respect to any of these actions is

unlikely to materially affect our financial position, results of operations or liquidity.

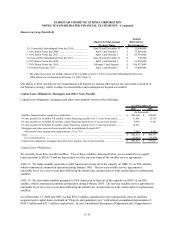

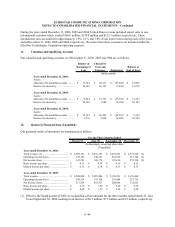

10. Segment Reporting

Financial Data by Business Unit

Statement of Financial Accounting Standards No. 131, “Disclosures About Segments of an Enterprise and Related

Information” (“SFAS 131”) establishes standards for reporting information about operating segments in annual

financial statements of public business enterprises and requires that those enterprises report selected information

about operating segments in interim financial reports issued to stockholders. Operating segments are components of

an enterprise about which separate financial information is available and regularly evaluated by the chief operating

decision maker(s) of an enterprise. Total assets by segment have not been specified because the information is not

available to the chief operating decision-maker. Under this definition we currently operate as two business units.

The All Other category consists of revenue, expenses and net income (loss) from other operating segments for which

the disclosure requirements of SFAS 131 do not apply.