Dish Network 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

57

commercial operation during the second quarter of 2006 and provided that other planned satellites are successfully

deployed, this increased satellite capacity and our 8PSK transition will afford us greater flexibility in delaying and

reducing the costs otherwise required to convert our subscriber base to MPEG-4.

While we may be able to generate increased revenue from such conversions, the deployment of equipment including

new technologies will increase the cost of our consumer equipment, at least in the short term. Our expensed and

capitalized subscriber acquisition and retention costs will increase to the extent we subsidize those costs for new and

existing subscribers. These increases may be mitigated to the extent we successfully redeploy existing receivers and

implement other equipment cost reduction strategies.

In an effort to reduce subscriber turnover, we offer existing subscribers a variety of options for upgraded and add on

equipment. We generally lease receivers and subsidize installation of EchoStar receiver systems under these

subscriber retention programs. As discussed above, we will have to upgrade or replace subscriber equipment

periodically as technology changes. As a consequence, our retention costs, which are included in “Subscriber-

related expenses,” and our capital expenditures related to our equipment lease program for existing subscribers, will

increase, at least in the short term, to the extent we subsidize the costs of those upgrades and replacements. Our

capital expenditures related to subscriber retention programs could also increase in the future to the extent we

increase penetration of our equipment lease program for existing subscribers, if we introduce other more aggressive

promotions, if we offer existing subscribers more aggressive promotions for HD receivers or EchoStar receivers

with other enhanced technologies, or for other reasons.

Cash necessary to fund retention programs and total subscriber acquisition costs are expected to be satisfied from

existing cash and marketable investment securities balances and cash generated from operations to the extent

available. We may, however, decide to raise additional capital in the future to meet these requirements. If we

decided to raise capital today, a variety of debt and equity funding sources would likely be available to us.

However, there can be no assurance that additional financing will be available on acceptable terms, or at all, if

needed in the future.

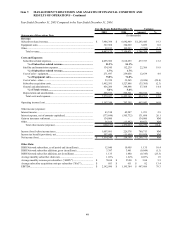

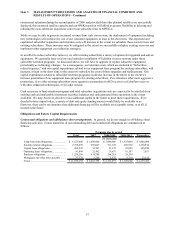

Obligations and Future Capital Requirements

Contractual obligations and off-balance sheet arrangements. In general, we do not engage in off-balance sheet

financing activities. Future maturities of our outstanding debt and contractual obligations are summarized as

follows:

Payments due by period

Total 2007 2008-2009 2010-2011 Thereafter

(In thousands)

Long-term debt obligations..................... 6,525,000$ 1,000,000$ 1,000,000$ 1,525,000$ 3,000,000$

Satellite-related obligations.................... 2,758,699 658,047 711,128 268,930 1,120,594

Capital lease obligations......................... 404,942 34,701 81,378 99,883 188,980

Operating lease obligations..................... 91,849 32,462 39,637 16,187 3,563

Purchase obligations .............................. 1,258,289 934,780 294,219 29,290 -

Mortgages and other notes payable ....... 37,379 3,768 5,675 5,710 22,226

Total....................................................... 11,076,158$ 2,663,758$ 2,132,037$ 1,945,000$ 4,335,363$