Dish Network 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–19

that require or permit fair value measurements. Accordingly, this statement does not require any new fair value

measurement. This statement is effective for fiscal years beginning after November 15, 2007, and interim periods

within that fiscal year. We are currently evaluating the impact the adoption of SFAS 157 will have on our financial

position and results of operations.

In September 2006, the Securities Exchange Commission Staff issued Staff Accounting Bulletin No. 108,

“Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in the Current Year

Financial Statements” (“SAB 108”). SAB 108 requires companies to quantify misstatements using both the balance

sheet and income statement approaches and to evaluate whether either approach results in an error that is material in

light of relevant quantitative and qualitative factors. SAB 108 also requires the effects of prior year uncorrected

misstatements to be considered when assessing the materiality misstatements in current-year financial statements. If

upon initial adoption, the cumulative effect of the misstatements is determined to be material using the new

guidance of SAB 108, companies are allowed to record the effects as a cumulative effect adjustment to beginning of

year retained earnings. SAB 108 is effective for the first fiscal year ending after November 15, 2006.

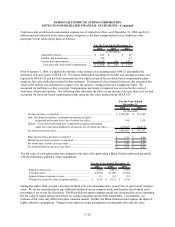

We adopted the provisions of SAB 108 during the fourth quarter of 2006. In accordance with the transition

provisions of SAB 108, we recorded a $62.3 million cumulative increase, net of tax of $37.4 million, to accumulated

deficit as of January 1, 2006. Historically, while our financial statements reflected payments to certain

programming and other vendors for a full year, each 12-month period included several days or weeks from the prior

calendar year. This discrepancy between our calendar and fiscal year for certain vendor accruals was immaterial to

prior years’ consolidated financial statements. However, the growth of our subscriber base over the past 10 years

has increased this discrepancy resulting in a cumulative increase to opening accumulated deficit of $78.4 million for

programming obligations and $21.3 million for other vendor obligations.

We concluded that these adjustments are immaterial to prior years’ consolidated financial statements under our

previous method of assessing materiality, and therefore elected, as permitted under the transition provisions of SAB

108, to reflect the effect of these adjustments in liabilities as of January 1, 2006, with the offsetting adjustment

reflected as a cumulative effect adjustment to opening accumulated deficit as of January 1, 2006.

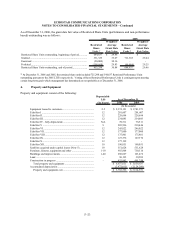

3. Stock-Based Compensation

In December 2004, the FASB issued Statement of Financial Accounting Standards No. 123R (As Amended), “Share-

Based Payment” (“SFAS 123R”) which (i) revises Statement of Financial Accounting Standards No. 123,

“Accounting and Disclosure of Stock-Based Compensation,” (“SFAS 123”) to eliminate both the disclosure only

provisions of that statement and the alternative to follow the intrinsic value method of accounting under Accounting

Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB 25”) and related interpretations,

and (ii) requires the cost resulting from all share-based payment transactions with employees be recognized in the

results of operations over the period during which an employee provides the requisite service in exchange for the award

and establishes fair value as the measurement basis of the cost of such transactions. Effective January 1, 2006, we

adopted SFAS 123R under the modified prospective method.